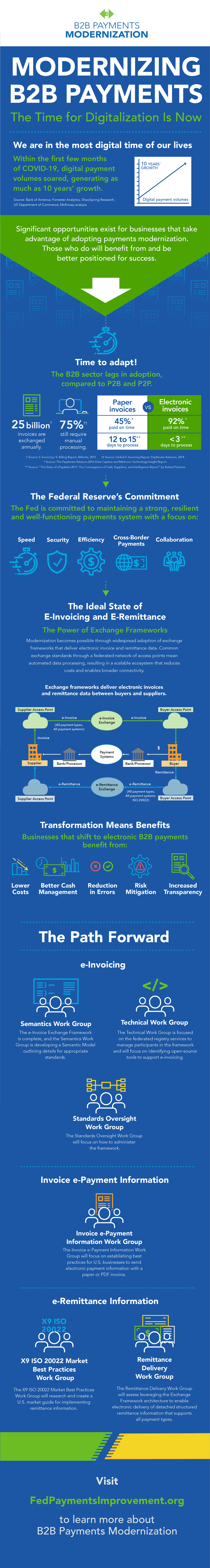

As digital payment volumes soar, there is no better time than the present for businesses to fully adopt digitalization and shift to electronic business to business (B2B) payments. Advanced technology has made streamlined processes the new normal, and for all kinds of businesses, embracing payments modernization will support future success. The Federal Reserve is committed to helping businesses do just that.

In a recent article, “Modernizing B2B Payments: The Time for Digitalization is Now” and in the infographic below, read more on the state of the industry, the benefits of successful adoption of digital processes, and what the Fed is doing to advance electronic B2B payments.

Importantly, B2B payments modernization cannot be done without committed industry players. The Fed relies on work groups and the industry as whole to support the progress needed for modernization. Interested in having a seat at the table?

In coming months, the Fed will begin recruiting for a Remittance Delivery Work Group that will assess an exchange framework architecture to enable electronic delivery of remittance information, broadening the capacity for different businesses to exchange e-remittance information. Stay up-to-date on the Remittance Delivery Work Group and the Fed’s continued efforts around payments efficiency by joining the FedPayments Improvement Community and selecting “E-invoicing” and “Electronic Payments and Remittance” under the interest preferences. As a member of the Community, you will receive the latest news around B2B payments modernization, opportunities to engage with the Fed and news from across the payments industry.