A key step toward modernizing business-to-business (B2B) payments involves achieving widespread adoption for businesses to exchange electronic remittance (e-remittance) information – or details about a payment – with each other. This is a challenge as remittance information is often sent in an unstructured format and is detached from the delivery of the payment.

The Federal Reserve has collaborated with the industry, including the Business Payments Coalition (BPC) (Off-site), to enable the widespread exchange of e-remittance information between businesses.

Until now, the retrieval of remittance information has been a largely manual process. However, momentum is building to solve this issue, promote adoption of e-remittance data and modernize the B2B exchange of information. Service providers, payment networks, industry organizations and financial institutions can amplify this momentum by getting involved in initiatives (Off-site) aimed at replicating the collaboration on e-invoicing to design industry solutions for e-remittance information.

While the remittance solutions landscape is still evolving, e-remittance capabilities play a strong role in reducing payment application costs and improving overall efficiency. All companies, regardless of size, can benefit from the modernization of remittance information to help reduce payment application costs and improve efficiency.

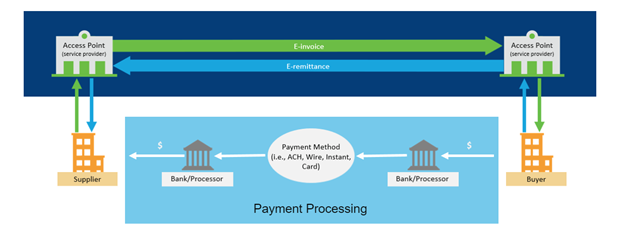

One of the key steps to achieving ubiquitous B2B electronic payments in the United States is establishing a standard way to send electronic invoices (e-invoices) and e-remittance data between businesses. An exchange framework, imagined by the BPC, is a way to do just that. This framework allows for improved payments efficiency by transforming processing of B2B payments from a fragmented, multi-step process to an automated one that, ideally, achieves straight-through-processing. The infographic below details how exchange frameworks allow for the widespread exchange of e-invoice and remittance data.

Industry Progress Towards E-Remittance Exchange

Many organizations are currently involved in advancing e-remittance capabilities. In early 2022, the Accredited Standards Committee X9’s ISO 20022 Market Practices Forum released the ISO® 20022 Remittance Content Market Guide to clarify what ISO 20022 remittance information to use with B2B payments. Read more about what’s included in the guide, why it matters and how this guide will further advance straight-through processing for B2B payments.

In June 2022, industry participants of the Fed and BPC’s Remittance Delivery Assessment Work Group found it feasible to establish a remittance exchange framework, similar to the e-invoice exchange framework.

Then, in the summer 2023, the BPC and Fed’s Remittance Delivery Work Group completed a validation phase, where they demonstrated an exchange framework can both facilitate the exchange of e-remittance information and enable straight-through processing, regardless of accounting system or payment method used.

From September 2023 to June 2024, the Business Payments Coalition, convened industry stakeholders to conduct an E-remittance Exchange Pilot. Pilot participants utilized an exchange framework to test the electronic exchange of e-remittance with a variety of businesses. In addition to piloting sending e-remittance information on a fully operational exchange framework, work group members finalized market practices for implementing the ISO 20022 remittance data model and prepared for the adoption of an operational exchange framework that supports sending and receiving e-remittance information along with e-invoices. Learn about the work of the E-remittance Exchange Pilot and explore pilot tools and resources, including the remittance data model on the BPC website (Off-site).