The payments industry regularly evaluates opportunities and solutions to mitigate losses associated with scams. A scams information sharing industry work group recommends that the industry consider creating a solution or establishing an independent information exchange framework to provide a holistic view of scam intelligence from existing sources across payment rails.

Stakeholders across the U.S. payments ecosystem lack real-time access to the current, industrywide information necessary to develop effective strategies to detect and prevent a growing number of scams – and other fraud types – that cause significant financial losses and negatively impact both consumers and organizations. Most information about fraud and scams remains siloed, causing fragmented, less effective attempts to combat them. Furthermore, information sharing is held back by the complexity of the challenge and lack of an industry-level solution.

“Disconnected efforts to detect and prevent scams allow fraudsters to repeat tactics – with minor variations – on multiple victims. Sharing information about these tactics and trends can help individual organizations and the entire industry work together to prevent and mitigate scam attacks.”

Mike Timoney, vice president of payments improvement

Federal Reserve Financial Services

The scams information sharing industry work group was launched in June 2023 with administrative support by the Federal Reserve. It is made up of 30 fraud prevention and payments experts from across the U.S. In August 2024, this group released a report (PDF) to recommend that the industry consider a solution or establish an independent information exchange framework to provide a single source for scam intelligence across payment rails, which includes ideas on how an exchange could be established and evolve. However, identifying or building a solution with the full functionality envisioned by the industry work group will take time.

What is the Path to Information Sharing?

An information exchange could connect existing and future information sources and allow organizations to gain a comprehensive view of emerging scam threats, patterns and tactics. It would enable better analysis and more effective preventative measures.

If the payments industry pursues an exchange, the industry work group recommends establishing a governing body – an industry-led group or coalition – to govern the information exchange and advance scam information sharing. Its purpose includes identifying scam information to be shared by payment stakeholders, developing an engagement plan to involve key stakeholders, recognizing gaps in the current information-sharing landscape, and determining priorities for effective information sharing. Subsequent steps would be to define permissible uses of the exchange, vet proposed participants based on industry standards and other criteria, outline privacy requirements, and evaluate options for a funding mechanism that offers access at minimal cost and encourages widespread use.

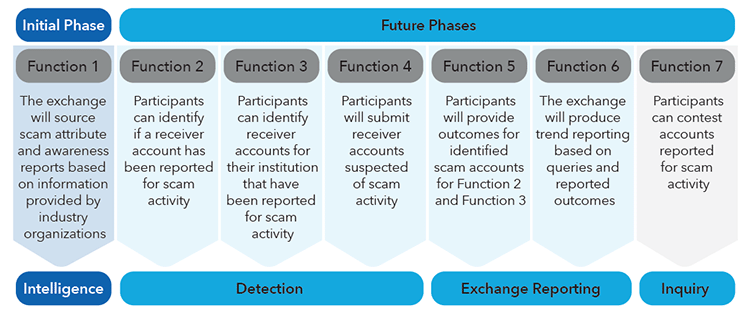

To expedite the exchange’s launch and value, the industry work group recommends a phased approach that starts with minimal viable functionality, as shown in the graphic below.

- In the initial “function 1” phase, organizations should be able to submit scam-related insights/trend data and access scam attribute and awareness reports, which in turn can be used by other participants to aid in detection and prevention of current and emerging risks. Exchange content could be aggregated and accessible through a portal or distributed to information exchange participants, with standardized templates and predefined fields to ensure consistency.

- Functions to be introduced in later phases would be focused on providing access to scam receiver account information and accepting scam data provided by participants.

Next Steps

The industry work group’s recommendations are intended to promote dialogue, identify key considerations, encourage action to increase information sharing, and ultimately thwart the growing impact of financially costly scams.

Explore the full report with recommendations (PDF). For the latest on continued efforts to help modernize the U.S. payment system and how scams information sharing can help the industry, join the FedPayments Improvement Community.