Enhancing business payment efficiency and promoting electronic payment adoption are two ongoing priorities within the payment system. While industry stakeholders have been working to help ease frictions in B2B payments, underlying challenges need to be addressed before most businesses can fully adopt electronic payments. This article will explore the challenges in B2B payments today and offer insight into industry initiatives that can help support progress.

Challenges with B2B Payments

Adoption of electronic B2B payments can be particularly difficult for small and medium enterprises. Business payments are more complex than consumer payments due to underlying accounting processes, such as accounts payable and receivable. Additionally, B2B payments lack common market practices for standards related to technology, remittance information, invoices and shipping documents, among other things.

Checks Versus Digital Payments

Many businesses rely on check payments and are either processing them in their back offices and depositing them at their bank or employing tools such as lockboxes, which are used by suppliers to collect payments from their customers. In a lockbox agreement (Off-site), the business establishes a relationship with a lockbox provider in which incoming checks are sent and the lockbox provider, generally a bank, collects, processes and deposits the checks. The service includes scanning and backing up attached remittance documents to electronically send to the business.

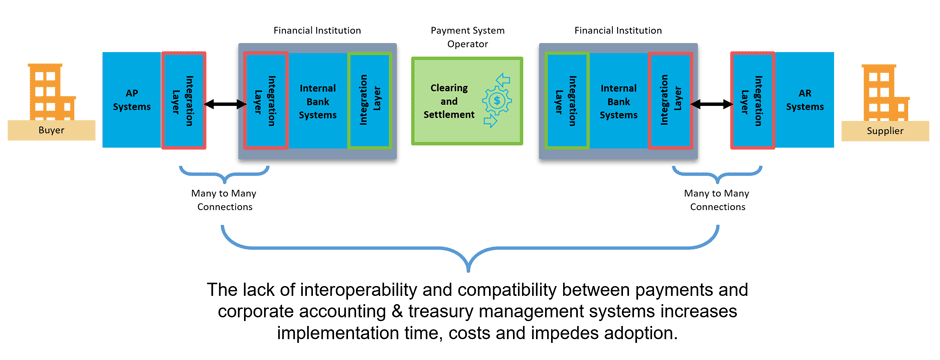

Businesses looking to switch from check to digital payments may be hindered by the higher costs of accounting and payment automation tools, as well as fees associated with initiating and receiving transactions electronically. Smaller businesses may also lack the personnel and IT resources needed to adopt electronic payments and integrate them with their existing accounting systems. Customer and vendor preferences for checks may further discourage the shift to electronic payments. Additionally, accounting systems designed to help businesses automate their back offices tend to be closed-loop and not interoperable. This results in businesses relying on multiple portals to exchange data related to electronic payments with their vendors and customers.

Beyond the back-office difficulties, businesses may hesitate to move to electronic B2B payments because checks are more suitable for tracking and processing remittance information about money that is sent from one party to another. Common electronic methods, such as ACH, do not inherently contain remittance information, and when they do, that information is not standardized. However, adoption of ISO® 20022 may positively impact standardization.

Accounting Pain Points

Frictions in accounts payable and accounts receivable processing also may impact business payment efficiency. Accounts payable (AP) refers to money a business owes to its suppliers. AP pain points include errors on manual, paper invoices; untimely invoice and payment approvals; and vendor management, which involves maintaining relationships, contract negotiation and gathering vendor information, such as payment information.

Accounts receivable (AR) refers to the money customers owe a business for goods and services delivered. AR pain points include managing information and retrieving payment data through multiple vendor portals, difficulties matching payments with payors and remittance advice that is unstructured and embedded in emails (i.e., proof from a customer to a vendor that an invoice has been paid).

In payment settlement, AP and AR often have misaligned incentives. The purchaser wants to hold onto its cash as long as possible (measured in part by days payable outstanding, or the average number of days it takes a company to pay its suppliers). Conversely, the supplier wants to be paid by its customers as quickly as possible (measured by days receivable outstanding). Both AP and AR can be impacted by various factors and errors that trigger vendor follow-up inquiries and sluggish back-and-forth responses, slowing payments further.

Why Electronic B2B Payments are Important

Businesses and the payments they make are incredibly important to the U.S. economy. Addressing B2B payment inefficiencies will help businesses improve their cash flows, reduce payment risks and provide better payment-related data.

In 2015, the Federal Reserve’s Strategies for Improving the U.S. Payment System paper stated that a greater proportion of payments originated and received electronically would reduce the average end-to-end (societal) costs of payment transactions and enable innovative payment services that deliver improved value to consumers and businesses. This desired outcome is still relevant today. For example, an exchange framework reduces the technology barriers and costs many businesses face when trying to exchange electronic documents. By reducing the number of electronic connects, businesses reduce their risks and streamline operations.

Industry stakeholders have been involved with multiple initiatives to improve business payment efficiency. Notably, the Business Payments Coalition (BPC, Off-site) defined and published requirements for a potential B2B payments directory, which later was adopted by Nacha to support its B2B directory, Phixius (Off-site). BPC work groups completed two pilots to test the exchange of electronic invoices (e-invoice) and electronic remittance information (e-remittance) through an exchange framework. Additionally, BPC E-invoice Exchange Market Pilot participants also launched the Digital Business Networks Alliance (DBNAlliance, Off-site) to oversee exchange framework standards, rules and guidelines.

The Federal Reserve monitors and analyzes the payments landscape to understand the dynamics between users and providers, how different types of users interact with the payment system, how new technologies are being implemented and their impact on users, as well as standards and consumer protection best practices.

This is the second in a series of Federal Reserve articles about the U.S. payments landscape. Read the initial article, Payments Landscape Series: The Evolving Customer Experience, and stay informed about future educational articles on the evolving U.S. payments landscape by joining the FedPayments Improvement Community.