A study of U.S.-based third-party enablers to financial institutions signals that instant payments are continuing to reach new heights due to interest in a widening and diversifying set of use cases for these types of transactions, according to the U.S. Instant Payments Adoption Quantitative Study (Off-site) (PDF) published by the U.S. Faster Payments Council (FPC).

In addition, the study shows that instant payment growth is being shaped by a combination of perceived benefits, access to the correct technology and emerging standards.

Top Use Cases Driving Adoption

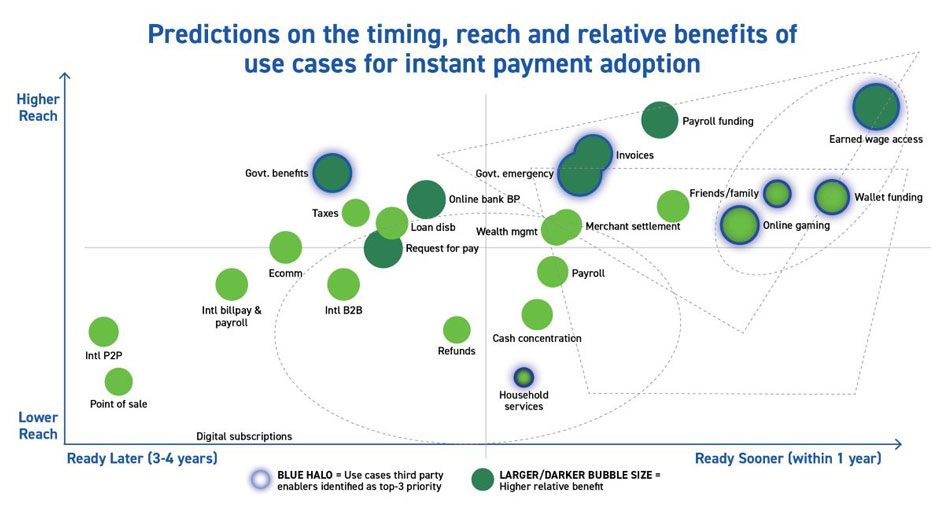

Study respondents said that certain use cases, such as immediate payroll, wallet payouts and person-to-person payments, have been more visible and remain key drivers of instant payment adoption. Additionally, loan disbursements (e.g., auto, real estate, etc.) have gained traction, adding to the range of instant payment use cases.

The study found that top use cases are propelled by two key factors: visibility and tangible value. Increased availability and organizational readiness, combined with direct improvements to the payment experience, are expected to be top drivers of growth in the years to come.

Survey respondents noted that progress has been made with QR codes, APIs and mobile wallets, and that the opportunity to grow request for payment includes significant work ahead.

Accelerating Instant Payment Adoption

Accelerating Instant Payment Adoption

The study underscores areas that respondents view as essential to advancing instant payment adoption in the near term. Over the next 12 to 24 months, they anticipate significant deployment of real-time fraud mitigation tools (78% rated this as top importance), as well as consumer and business user interfaces (both rated 72% top importance).

Emerging technological tools also will remain important, with interest bubbling in aliases (44%), request for pay (RFP) solutions (39%), pay by bank solutions (33%) and QR codes (17%). Honing in on specific market needs and precise use cases in development and deployment processes for these technologies will help drive growth in the year to come.

“The insights from this study demonstrate both the scale of progress already made and the opportunities still ahead,” said Reed Luhtanen, FPC executive director and chief executive officer. “Instant payments are increasingly becoming a part of everyday transactions for consumers and businesses. As adoption accelerates, the FPC is working with members and stakeholders across the industry to address remaining challenges and ensure these capabilities are accessible, secure and beneficial for all.”

About the Study

The study, conducted during the summer of 2025, included responses from two dozen third-party enablers such as payment processors, gateways, digital vendors, bankers’ banks and corporate credit unions, collectively serving 90% of U.S. financial institutions. The survey measured industry perspectives on adoption, benefits and challenges expected through 2028. Federal Reserve Financial Services, a founding sponsor of the FPC, contributed to the implementation and analysis of the study.