To continue addressing the growing threat of synthetic identity fraud (SIF) – which is often miscategorized and misunderstood – new resources targeting education and awareness, detection, and mitigation strategies are being developed for the payments industry.

In April of this year, the Federal Reserve released an industry-recommended definition of synthetic identity fraud, which was developed in collaboration with payments fraud experts. This common definition is an important step toward more consistent identification and classification, which can help the industry begin necessary conversations about this issue.

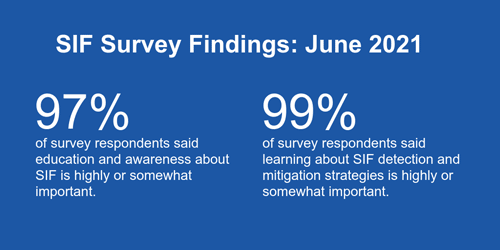

In an effort to support the payments industry in its battle against this type of fraud, the Fed is taking the next step by developing a “Synthetic Identity Fraud Mitigation Toolkit.” The intent of this toolkit is to develop a repository of educational resources for financial institutions, consumers and businesses. Based upon numerous interviews with payments fraud experts and a June 2021 survey conducted by the Fed, feedback suggests there is a real need for education and awareness, detection and mitigation strategies and learnings, and industry collaboration.

This new toolkit will provide additional insights and resources for identifying and mitigating synthetic identity fraud, specifically to:

- Increase education and awareness about SIF

- Enable the payments industry to better identify and fight SIF

- Foster payments industry collaboration on SIF mitigation

- Encourage future improvements in SIF data collection and sharing

The Fed plans to release the first phase of the toolkit in early 2022. Learn more about the Fed’s efforts on synthetic identity fraud, as well as how experts from across the payments ecosystem are using the industry-recommended definition of synthetic identity fraud to help combat this type of fraud.