As technology progresses, digital processes are becoming more prevalent in many aspects of everyday life, including the way purchases are made. From online shopping, to delivery services, contactless in-store payment and the ability to make person-to-person (P2P) payments via smartphones, the payments industry is rapidly moving toward digitalization.

While consumers have rapidly transitioned from paper to digital transactions, businesses have lagged behind. A staggering 75% of the 25 billion business-to-business (B2B) invoices exchanged annually in the United States still require manual processing. Manual processing of B2B payments is highly labor-intensive, prone to fraud and more costly than automated alternatives.

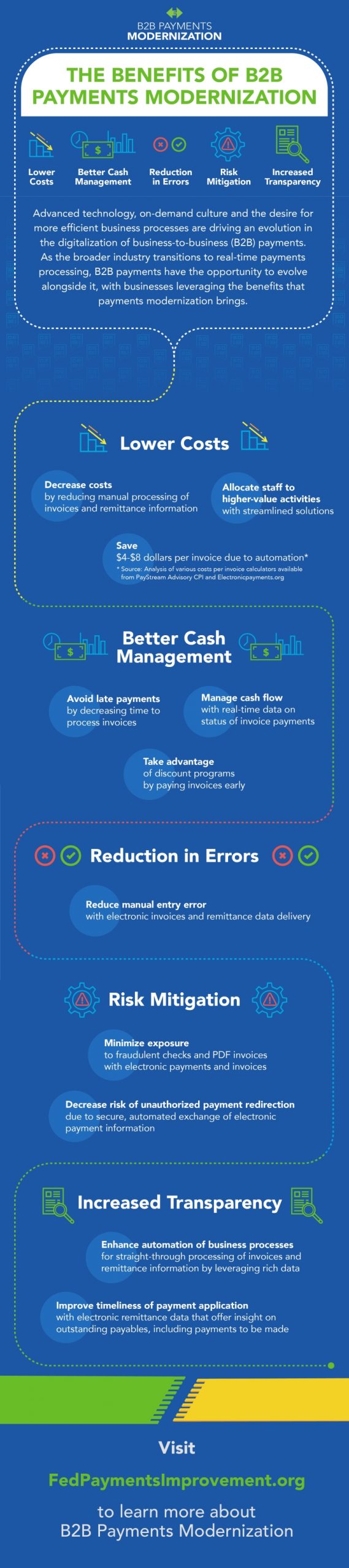

Recent progress towards the digitalization of B2B payments and the broader industry’s transition to real-time payments processing now present an exciting opportunity to modernize B2B payments with a standardized ecosystem for electronic transactions.

Businesses of all types gain from this transformation, as the migration from manual to digital processes brings many benefits including lower costs, better cash management, error reduction, risk mitigation, increased transparency and improved automation of business processes.

Looking for more insight on these benefits and what they mean for you and your organization? Check out the top benefits of adopting digital B2B payments processes in the infographic below.

Check back for updates and stay up to date on the latest B2B payments modernization news by following us on LinkedIn (Off-site) and Twitter (Off-site).