The Federal Reserve is participating in a Committee on Payments and Market Infrastructures (CPMI) Cross-border Payments Task Force to identify ways to promote cross-border payments that are faster, less expensive and more transparent and inclusive.

The CPMI, an international committee within the Bank of International Settlement (BIS), promotes the safety and efficiency of payments, clearing and settlement systems, and formed its Cross-border Task Force in December 2019 in coordination with the Financial Stability Board (FSB). This focus supports a G20 priority under the 2020 Saudi Arabian Presidency to enhance cross-border payments in order to promote economic growth, international trade, global development and financial inclusion to benefit citizens and commerce worldwide.

On July 13, the CPMI Task Force issued its second report: Enhancing cross-border payments: building blocks of a global roadmap (Off-site), identifying focus areas and building blocks for enhancing cross-border payments. It follows a Stage 1 report (Off-site) released in April 2020 assessing existing cross-border arrangements and challenges, and will conclude with a Stage 3 report outlining a roadmap for ecosystem improvements. A final, joint report will be submitted to the G20 in October 2020.

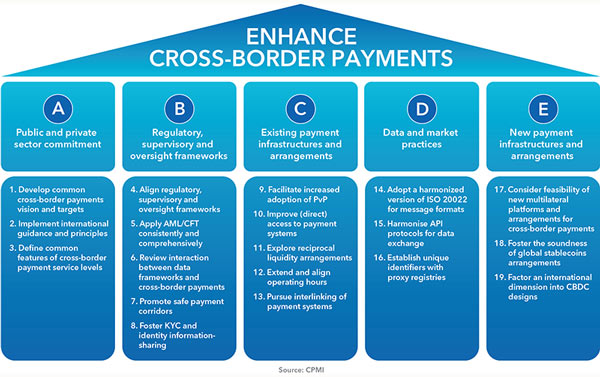

This most recent Stage 2 report lays out 19 building blocks within five focus areas geared toward addressing the long-standing frictions and pain points in cross-border payments. The building blocks identify areas where further work may improve cross-border payments frictions identified in Stage 1: long transaction chains, complex processing and compliance checks, weak competition and other pain points resulting in high costs, low speed and limited access and transparency.

These building blocks acknowledge the need for global cooperation along with advancements in technology and infrastructure that are considered essential for improving cross-border money movement. The report also highlights the COVID-19 pandemic and its impact on individuals and economies, and emphasizes the importance of maintaining momentum in the improvement of cross-border payments in order to support the post-pandemic global economy.

Learn More

The Federal Reserve participates in this Task Force work alongside more than 20 central banks and with observers from the BIS, FSB, the Basel Committee on Banking Supervision, the Financial Action Task Force, the International Monetary Fund and the World Bank Group. For more information on CPMI’s research and publications, visit the BIS website (Off-site).

The Federal Reserve also continues to independently monitor developments in cross-border payments and engage with stakeholders to gather input and foster broader industry education and dialogue in support of cross-border payments ecosystem evolution. Check back for updates and to learn more about the cross-border payments landscape and initiatives underway.