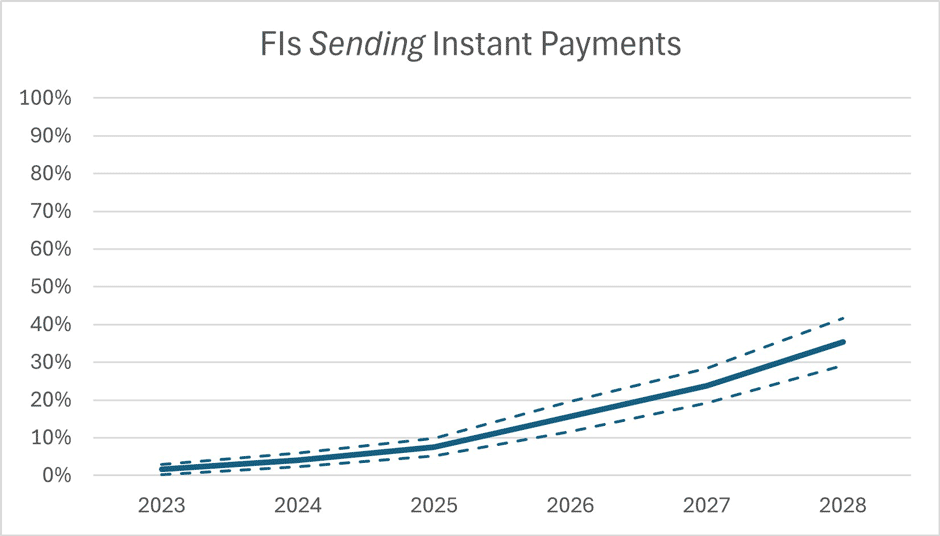

A new study sheds light on the various factors shaping the future of instant payments. One of the key findings is that by 2028, an estimated 70% to 80% of U.S.-based financial institutions will be enabled to receive instant payments, with 30% to 40% being enabled to send instant payments, according to the U.S. Instant Payments Adoption Quantitative Study (Off-site) published by the U.S. Faster Payments Council (FPC).

Projected growth of instant payment send and receive enablement among U.S.-based financial institutions by 2028.

The study, which examined factors impacting faster and instant payment adoption in the U.S., reflects the inputs and opinions of financial institution service providers, including payment processors, gateways, digital vendors, bankers’ banks and corporate credit unions. In total, study respondents support 90% of U.S.-based financial institutions.

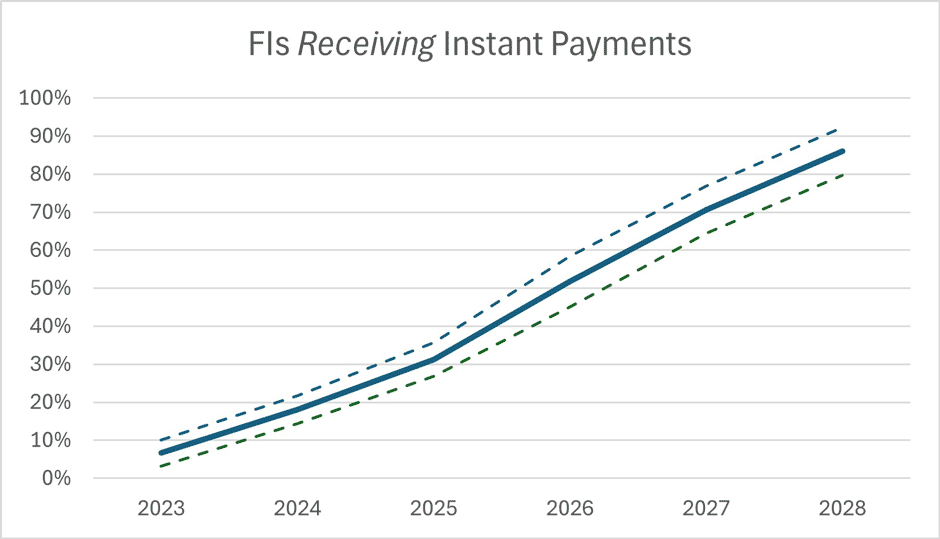

Top Use Case Drivers

Some of the leading early adoption drivers include earned wage access, wallet funding and person-to-person transactions. Other use cases such as business-to-business payments and online banking bill pay are anticipated to spur broader adoption in the mid-term.

Predictions on the timing, reach and relative benefits of use cases for instant payment adoption.

Overview

The chart, “Predictions on the timing, reach and relative benefits of use cases for instant payment adoption,” shows a number of use cases, arranged according to when they will be ready (later versus sooner) and the anticipated amount of reach and relative benefit they will have (lower versus higher).

Values

| Category | Use Case | Use Case – Shortened | Timing | Reach | Benefit |

|---|---|---|---|---|---|

| A2A | A2A – Cash conc | Cash concentration | 1.50 | 1.82 | 2.05 |

| A2A | A2A – Wealth mgmt | Wealth mgmt | 1.52 | 2.10 | 2.05 |

| B2B | B2B – Invoices | Invoices | 1.58 | 2.36 | 2.54 |

| B2B | B2B – Merch settle | Merchant settlement | 1.72 | 2.17 | 2.13 |

| B2B | B2B – Payroll funding | Payroll funding | 1.68 | 2.48 | 2.50 |

| B2P | B2P – EWA | Earned wage access | 2.00 | 2.52 | 2.67 |

| B2P | B2P – Insurance pmts | Insurance pmts | 1.54 | 2.12 | 2.13 |

| B2P | B2P – Online gaming | Online gaming | 1.80 | 2.12 | 2.13 |

| B2P | B2P – Payroll | Payroll | 1.52 | 1.96 | 2.04 |

| B2P | B2P – Refunds | Refunds | 1.38 | 1.76 | 1.88 |

| B2P | G2P – Adhoc disb | Govt emergency | 1.57 | 2.29 | 2.63 |

| B2P | G2P – Benefits | Govt benefits | 1.20 | 2.29 | 2.25 |

| B2P | G2P – Loan disb | Loan disb | 1.28 | 2.13 | 2.17 |

| Intl | Intl – B2B | Intl B2B | 1.21 | 1.92 | 2.22 |

| Intl | Intl – Billpay & Payroll | Intl billpay & payroll | 1.04 | 1.92 | 2.17 |

| Intl | Intl – P2P | Intl P2P | 0.85 | 1.75 | 2.09 |

| P2B | P2B – Digital subscriptions | Digital subscriptions | 1.06 | 1.42 | 1.35 |

| P2B | P2B – Ecomm | Ecomm | 1.13 | 2.04 | 2.21 |

| P2B | P2B – Online bank BP | Online bank BP | 1.33 | 2.21 | 2.29 |

| P2B | P2B – POS | Point of sale | 0.88 | 1.58 | 1.96 |

| P2B | P2B – RFP | Request for pay | 1.27 | 2.04 | 2.38 |

| P2B | P2B – Wallet funding | Wallet funding | 1.94 | 2.21 | 2.08 |

| P2B | P2G – Taxes | Taxes | 1.23 | 2.16 | 2.00 |

| P2P | P2P – Friends/Fam | Friends/fam | 1.85 | 2.21 | 1.83 |

| P2P | P2P – HH services | Household services | 1.48 | 1.58 | 1.63 |

Presentation

The chart shows use cases depicted as green bubbles of various sizes, depending on the predicted timing of the use case and the reach and relative benefit of the use case. The size of the bubble and the placement on the chart are based on two factors. The use case bubbles with the highest relative benefit are larger. The use case bubbles that will be ready sooner are located to the right.

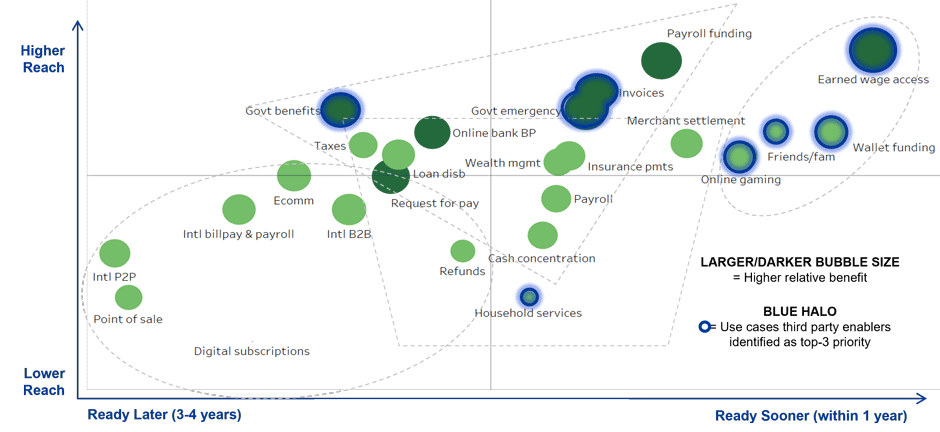

Headwinds and Tailwinds of Instant Payment Adoption

Respondents also provided insight into the challenges and opportunities impacting instant payment adoption. Their impressions indicate there is room for the industry to foster use cases that will help accelerate instant payment adoption rates.

- Respondents shared that the ubiquitous availability of fraud tools, alias tools and user interfaces are factors that will help promote faster and fuller adoption of instant payments.

- Respondents noted that continued clarification of rules and standards will be increasingly important to drive adoption and will often be use-case specific.

Quantifying relative headwinds and tailwinds for instant payment adoption.

Overview

The table “Quantifying relative headwinds and tailwinds for instant payment adoption,” shows the aggregate value respondents gave to various challenges and opportunities impacting instant payment adoption.

Values

| Headwinds and Tailwinds | Aggregate Value using a scale of 1-6 where 1 is a strong headwind and 6 is a strong tailwind and 3.5 is the mid-point. |

|---|---|

| Operational and technological readiness | 2.6 |

| Business customer awareness | 2.6 |

| Consumer customer awareness | 2.8 |

| Go to market toolkits | 3.1 |

| Alias enablement | 2.2 |

| QR codes | 2.8 |

| APIs | 2.9 |

| Request for payment | 3.1 |

| Fraud Tools | 2.2 |

| End user interfaces | 2.5 |

| Error resolution | 2.9 |

| Workflow automation | 3.1 |

| Reconciliation | 3.2 |

| Rules and standards | 3.4 |

| Training and documentation | 3.5 |

| Network reach | 1.9 |

| Organizational buy-in | 2.3 |

| Cost and ease of integration | 2.4 |

| Use case activation | 3.6 |

Presentation

The bar chart lists headwinds and tailwinds on the left, and shows blue bars for items that are headwinds, which could slow adoption of instant payments, and green bars for items that are tailwinds and could increase adoption of instant payments.

The chart shows that there are more headwinds than tailwinds.

The chart uses a scale of 1 through 6 — where 1=Strong headwind, 2=Moderate headwind, 3=Mild headwind, 4=Mild tailwind, 5=Moderate tailwind, and 6=Strong tailwind. A score of 3.5 is neutral.

(For the chart above, the scale is 1 through 6 — where 1=Strong headwind, 2=Moderate headwind, 3=Mild headwind, 4=Mild tailwind, 5=Moderate tailwind, and 6=Strong tailwind. A score of 3.5 is neutral.)

“The results of this new study highlight the momentum and optimism within the payments industry. The widespread adoption of instant payments will not only enhance user experiences but will also foster greater competition, innovation and inclusion in financial services. The FPC remains committed to addressing the headwinds and enabling faster payment solutions for all.”

Reed Luhtanen, FPC executive director

About the Study

The study of 25 core processors, bankers’ banks, corporate credit unions and fintech providers was conducted July 1-Aug. 16, 2024. Questions were designed to gather quantitative information on the current state and outlook for instant payment adoption, as well as use case priorities and market headwinds and tailwinds. Federal Reserve Financial Services was a contributor to the Instant Payments Adoption Outlook, assisting with survey implementation and analysis.