Standards provide a foundational layer for advancing payment security, efficiency and accessibility. They can create a common language and improve the safety and interoperability of the payments ecosystem.

Defining Payment Standards

A standard contains specifications and procedures that are designed to be used consistently as a rule or guideline. Standards help promote the consistent operation products and services licenses, ID cards and insurance cards people carry in their wallets. An international standard specifies the physical dimensions of identification cards (Off-site) and has been widely adopted across countries, industries, wallet designers and manufacturers. Similarly, the way credit and debit cards operate and their security measures also are standardized.

Payment standards are invisible to most end users but provide the foundation for nearly all payment systems. Payment standards describe the structure that makes it easier for service providers, vendors, merchants and customers to exchange the information they need to make purchases using different channels (e.g., in stores, online and/or using mobile devices and apps) and conveniently, securely pay for their acquisitions.

The impact of standards is more likely to be felt when they are absent, such as when products, services and technologies are not compatible. For example, contactless payments rely on near-field communication (NFC) interface standards (Off-site) for coding, format and data exchange methods to support consumers in completing contactless payments at any merchant or business. These standards apply to NFC chips across products and services and have made a huge difference to payment users. Conversely, the absence of a single or common standard can occur when market fragmentation leads to many proprietary formats for a given technology. For example, people would be much more limited in where they could shop if it was necessary to use the same provider for both a credit card and a point-of-sale system. With the large and ever-growing variety of payment products offered, it is important to support compatibility to promote both payment efficiency and competition.

What Standards Development Organizations Do

Domestically and internationally, Standards Development Organizations (SDOs) aim to promote the safety, reliability and efficiency of products and services, and encourage technology interoperability. The primary function of an SDO is to publish and promote the adoption of specifications, procedures, design and/or technical characteristics that have been developed by subject matter experts and approved by a recognized standards-setting body. An important feature of standardization is that it is designed to optimize order in a given context (Off-site). In other words, standards provide enough specificity and clarity to support compatibility without stifling innovation.

The standards development process typically brings together subject matter experts from a range of stakeholder groups, including competitors, user communities, interest groups and governments. This type of SDO establishes and publishes documentation that outlines specifications, procedures, design or technical characteristics codifying the industry’s experience and expertise. The documentation then serves as a common foundation to build innovations upon. Many standards are developed and adopted on a voluntary basis, meaning they are not policies, regulations or law and therefore, do not impose any adoption, compliance or use requirements. However, standards may be referenced in regulatory or other legal communications.

Internationally, the International Organization for Standardization Technical Committee 68 (ISO®/TC68, Off-site) is the primary standards development organization for the financial services industry. ISO/TC68 covers retail banking, capital markets, payments, credit card processing and information security in financial services. Domestically, Accredited Standards Committee X9 (ASC X9, Off-site) develops financial industry standards for the U.S.

The ISO 20022 standard, for example, is a global financial industry messaging standard, which includes payments. This standard allows businesses, financial institutions and all other parties involved in a financial transaction to exchange, interpret and automatically process payment information. It creates a common global language to exchange data across the financial services industry in a way that allows for automatic processing. Use of this standard allows organizations to leverage the structured data the standard offers, to not only reduce costs but also identify areas of innovation. Broad adoption of ISO 20022 will allow organizations to transition from multiple proprietary communication mechanisms to a single standard to streamline communication (Off-site) across the many entities and financial intuitions they engage with.

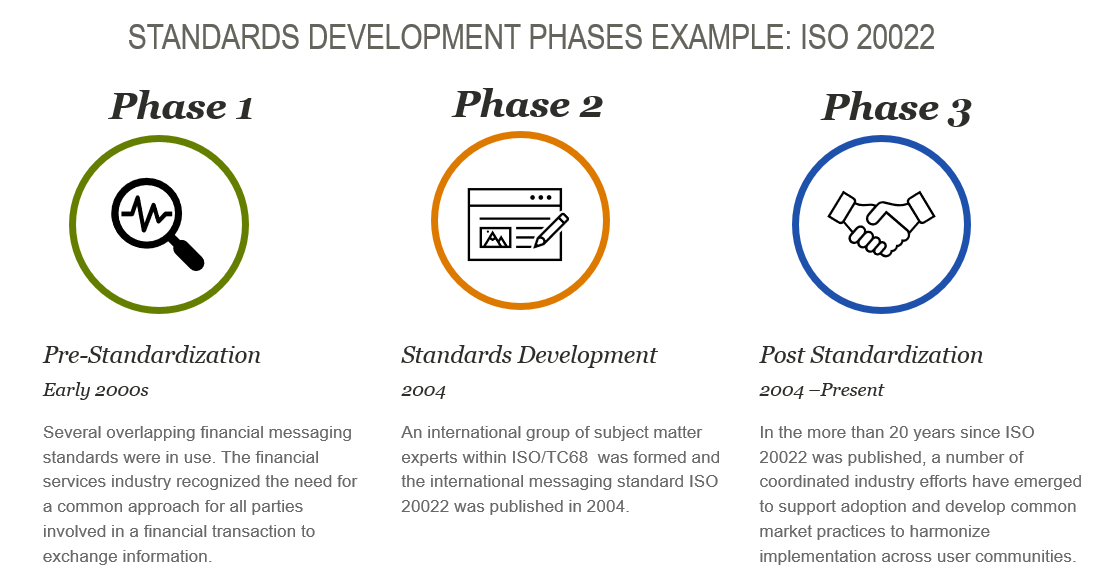

Three Phases of the Standards Development Process

- Pre-standardization: Before a standard is developed, the industry typically confirms that there is a gap or need that can be addressed either by a new standard or updates to an existing standard. This can include activities like conducting landscape assessments to identify gaps or needs across the ecosystem that standards can help address.

- Standards development: This phase is where the industry comes together to address a particular gap or need. A call for industry experts is issued to facilitate establishment of a work group within an SDO. The work group develops technical content that must be agreed upon by the participating subject matter experts before it can be reviewed and approved by a domestic or international standards-setting body.

- Post-standardization: When it comes to developing and implementing a standard, simply publishing a standard is not enough. The standard should be implemented in a harmonized way to achieve widespread adoption and avoid perpetuating the same frictions that necessitated a need for the standard in the first place.

The Importance of Standards

Both the development and adoption of standards enable front and back-end users to exchange the necessary information for convenient, secure payment transactions. Over the years, industry standards have been shown to help catalyze payments innovation.

In 2017, the Federal Reserve published Strategies for Improving the U.S. Payment System: Federal Reserve Next Steps in the Payments Improvement Journey. This paper reaffirmed that to achieve greater end-to-end efficiency for domestic payments, the Federal Reserve supports industry efforts to develop and promote adoption of standards that enable electronic processing of business invoices, payments and remittance information. According to the 2017 paper, “delivering end-to-end improvements will require action on the part of all organizations involved in payments.” This can be accomplished through common best practices, standards implementation, system upgrades and research contributions, among other things.

Depending on the priority, the Federal Reserve participates in, monitors and/or leads activities in both domestic and international standards bodies, including the aforementioned ISO/TC68 and ASC X9. Collaboration with standards groups supports the Fed’s mission to foster the integrity, efficiency and accessibility of U.S. payments and settlement systems. The Fed’s engagement in payment standards supports the efficiency, security and alignment of Federal Reserve Financial Services offerings with broader industry needs.

The Federal Reserve monitors and analyzes the payments landscape to understand the dynamics between users and providers, how different types of users interact with the payment system, how new technologies are being implemented and their impact on users, as well as standards and consumer protection best practices.

This is the third in a series of Federal Reserve articles about the U.S. payments landscape. Read the other articles, Payments Landscape Series: The Evolving Customer Experience and Payments Landscape Series: Frictions in B2B Payments. Stay informed about future educational articles on the evolving U.S. payments landscape by joining the FedPayments Improvement Community.