According to a new survey by the Federal Reserve (PDF), U.S. businesses of all sizes see increased need for faster payments for a variety of transactions, including business-to-business, person-to-business and business-to-person payments.

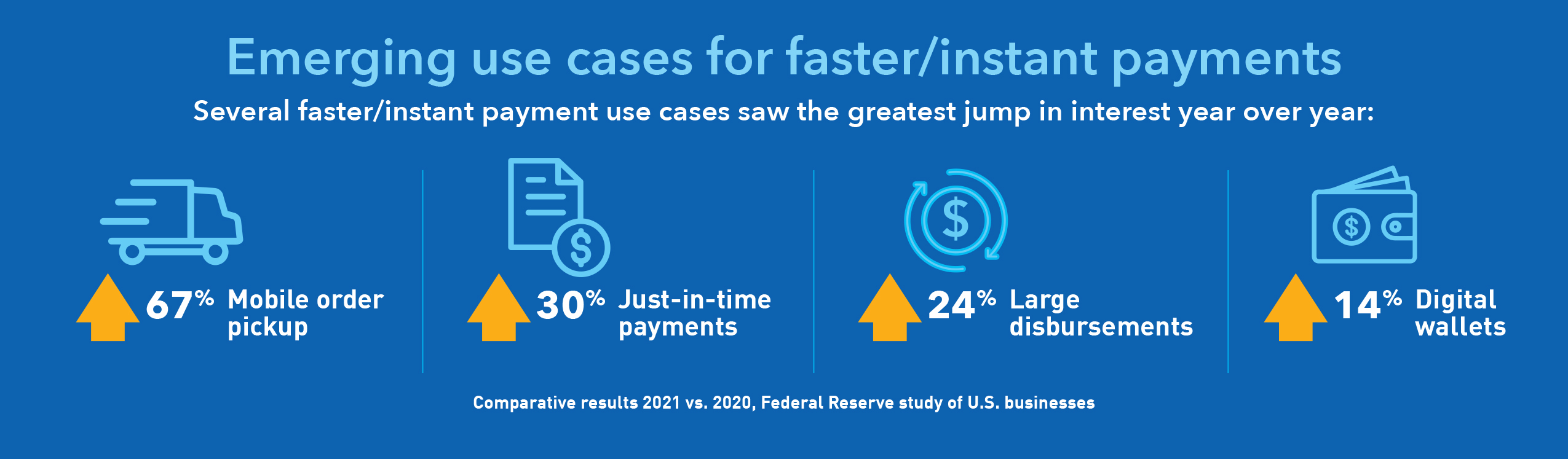

Interest in certain use cases, such as e-invoicing and bill payment with remittance information, remained strong and consistent year over year, while the greatest growth was found in emerging faster payment use cases tied to day-to-day business operations, as shown below.

“U.S. businesses clearly see the value of faster payments. The Federal Reserve’s upcoming FedNow Service will provide financial institutions with a platform they can use to build and deliver the instant payment solutions their business customers are demanding.”

Connie Theien

Head of industry relations for Federal Reserve Financial Services

Other key findings from the survey included:

- Businesses are seeking faster/instant payment solutions because of their key features: quicker access to funds (60%), immediate notification of when the payment arrives (58%), the ability to post immediately or automatically to customers’ accounts (57%), and the inclusion of remittance details alongside issued payments (55%).

- Consistent with last year’s survey, businesses indicated the faster/instant use cases they’re most interested in include payroll, recurring bill payments, internal transfers, and regular or routine payments.

- Nearly 40% signaled interest in faster/instant payment options that might reduce the overall costs of financial operations.

- Nearly nine in 10 businesses expect to be ready to make and support 24x7x365 faster payments within the next three years.

A full report on the survey can be found here (PDF).

To learn more about how faster/instant payments can benefit businesses of all sizes, view this article (Off-site).

Get ready for the FedNow Service

For information on instant payments and the FedNow Service, visit FedNow Explorer (Off-site). You can also stay up to date on our instant payments initiatives by signing up for FedNow News (Off-site).