As the broader payments industry transitions from paper checks to instant payments, and emerging technologies define an increasingly digital landscape, now is the time for business-to-business (B2B) payments to leverage this momentum for change. Ultimately, such change presents an opportunity for the industry to transform B2B payments and generate modernized solutions.

A key step in modernizing B2B payments in the United States is establishing a standard way for businesses to send electronic invoices (e-invoices), payment and remittance (e-remittance) information to one another. A virtual, interoperable electronic delivery network that facilitates the exchange of electronic information is a framework that would enable such transactions.

Earlier this year, the Business Payments Coalition (BPC) released the results of a proof of concept for an electronic e-invoice exchange framework (Off-site) that, if successfully implemented, would provide a path forward for businesses to send, receive and automate straight-through-processing for invoices. The BPC and the Federal Reserve are assessing whether a similar exchange framework can facilitate electronic delivery of remittance information.

An electronic exchange framework is a set of standards, policies and guidelines enabling businesses to connect once, and exchange with anyone on the exchange framework, independent of their platform, system, or application. The e-invoice exchange framework operates similarly to e-mail exchange frameworks. With email networks, e-mail users sign up with an email provider (e.g., Gmail) to send and receive email. The email providers then serve as access points into email exchanges for their users and deliver emails between users over the internet. The email network effect allows a user to sign up once, and then connect and exchange emails with many others in the network.

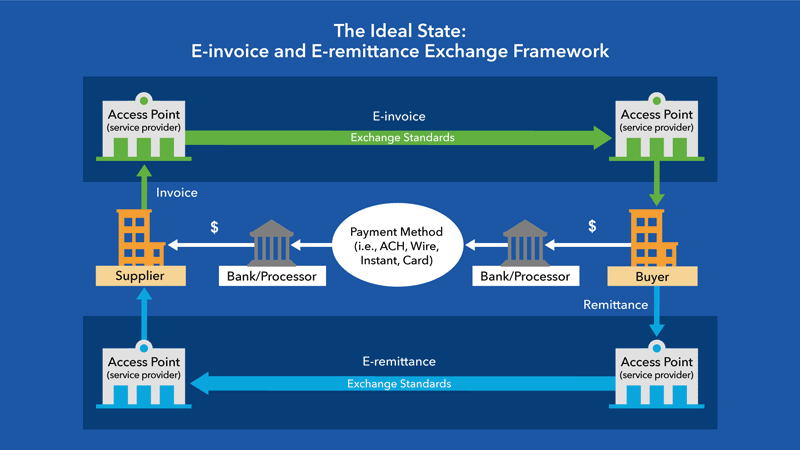

In an exchange network, service providers act as access points to deliver and receive data and information for their business clients. Instead of email, in the exchange framework, they deliver businesses’ e-invoice data. Thus, this virtual network allows access points to find and connect business end points while preserving client confidentiality. With an established set of standards, policies, and guidelines, an e-invoice exchange framework allows businesses to exchange with many others through one connection to the network. In an ideal state for B2B payments, these exchanges will support both invoices and payment remittance information and enable straight-through-processing of both.

The infographic below details this ideal state for e-invoice and e-remittance exchange.

E-invoice Exchange Framework Explained: A Walk-Through of the Framework

First, a supplier (middle row, left) engages with their e-invoice provider, or access point (top row, left). They issue the invoice and send it to the access point in the format their systems currently support. The supplier’s access point transforms the invoice into an exchange standard format and delivers the invoice to the buyer’s access point (top row, right). This is depicted through the green arrow at the top of the diagram. The buyer’s access point then converts the invoice to the buyer’s required format and sends it to the buyer (middle row, right).

The buyer then processes the invoice through a bank/processor and pays through whichever payment type they prefer, including ACH, wire, instant or card payment (middle row). The supplier then receives the payment through their bank/processor and the transaction is complete (middle row, left).

These virtual exchange networks are frictionless for both the supplier and buyer. They support all payment types and address two of the most challenging inefficiencies for electronic payments – manual processing of invoices and remittance information.

To test the framework, the BPC, with the support of the Fed, will pilot an e-invoice exchange framework through the E-invoice Exchange Market Pilot set to go live in early 2022. The desired outcome of this market pilot is an operational B2B invoice exchange framework for the U.S. market.

It may be possible to send remittance information through a parallel set of access points in the same way as invoices, as depicted through the blue row on the bottom of the diagram. Sending remittance information within a payment, such as in an ACH addenda or within the ISO 20022 payment message, is still an option. The exchange network provides another option to send structured data when remittance information is complex, voluminous or there are technical barriers to sending it with the payment. This flexibility helps to meet business needs. The BPC and the Fed are forming a Remittance Delivery Assessment Work Group to assess what it would take to establish a similar exchange framework to facilitate electronic delivery of remittance information across all payment types.

Interested in seeing this work progress? Want to be part of the change? Join the FedPayments Improvement Community (select “E-invoicing” and “Electronic Payments and Remittance” under the interest preferences), and follow FedPayments Improvement on LinkedIn (Off-site) and Twitter (Off-site).