The Federal Reserve’s FraudClassifierSM model has achieved growing global adoption among financial institutions, fintechs and payment service providers, as well as the ability to offer greater value through integration with the ScamClassifierSM model introduced in 2024.

“In just five years, the FraudClassifier model has gone from a promising framework to a widely adopted industry model — gaining momentum as financial institutions recognize the power of speaking the same fraud language,” said Rene Perez, CAMS®, financial crimes consultant and national director of financial crimes sales at Jack HenryTM. “The model doesn’t just classify fraud — it clarifies it. That clarity empowers faster decisions, sharper investigations and better outcomes.”

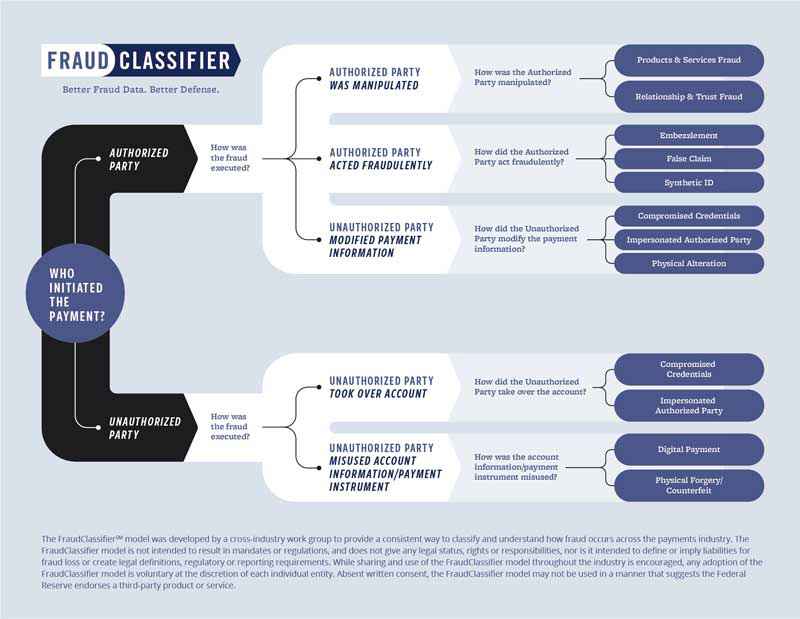

The FraudClassifier model benefits organizations seeking to better identify, classify and address fraud threats in a rapidly evolving payments landscape. The model is a simple — yet intuitive — framework to bring consistency and clarity to fraud classification across the payments industry. Designed in collaboration with industry stakeholders and launched in 2020, the FraudClassifier model takes a decision-tree approach and uses supporting key terms and definitions to categorize fraud based on the method of execution and whether the transaction was authorized by the account holder. This classification structure creates a consistent way to analyze and report fraud incidents for all payment types, which helps organizations better understand trends and strengthen prevention strategies. Organizations that incorporate the FraudClassifier model into their processes report that they use it to enhance internal reporting, support data-driven fraud mitigation strategies and improve coordination across the payments industry.

As its most recent milestone, the model has gained international traction. Payments NZ (Off-site) Aotearoa New Zealand’s three core payment clearing systems, has adopted the FraudClassifier model for use by its member organizations. This is a step toward global fraud classification consistency and underscores the model’s international relevance.

“The FraudClassifier model has been quite the revelation from a reporting point of view, was more straightforward to implement than we expected, and is so easy to follow as a framework,” said Jane-Renee Retimana, chief strategy and innovation officer of Payments NZ. “Its structure has helped our members streamline industry fraud reporting and align with international best practices.”

“Adoption by Payments NZ is a testament to the model’s versatility and its importance as a global resource. We’re proud of how far the model has come and look forward to continued collaboration with international and domestic partners to address fraud.”

Michael Timoney, vice president of payments improvement

Federal Reserve Financial Services

Alignment with the ScamClassifier Model Strengthens Fraud Response Capabilities

As fraud and scam tactics continue to evolve, interoperability between classification frameworks is essential. The FraudClassifier model is designed to align with the ScamClassifier model — a complementary framework developed to address socially engineered scams, including authorized push payment (APP) fraud and impersonation attacks.

The two models are intentionally structured in a way that allows them to be used together — or independently — so organizations can classify both fraud and scams with consistency and precision. While the FraudClassifier model focuses on both authorized and unauthorized party fraud to observe the full range of fraud activity, the ScamClassifier model adds clarity on activity resulting from scams — bridging an important gap in industry reporting.

Together, these models support a holistic approach to fraud and scam classification across the payments industry. Financial institutions can leverage both models to achieve a more detailed view of the most prevalent trends, improve risk insights, and streamline reporting and response efforts across channels and payment types.

Looking Ahead

With the continued rise in digital payment volume and increasing sophistication of fraud and scam tactics, it has never been more critical to have consistent, integrated classification tools that are simple and easy to use. The Federal Reserve plans to continue promoting the FraudClassifier model in partnership with industry stakeholders to encourage continued growth in adoption and meet future fraud challenges.

As it enters its sixth year, the FraudClassifier model’s expanding adoption — and its strategic alignment with complementary frameworks, such as the ScamClassifier model — represent progress in building a more fraud-aware, resilient and globally connected payments ecosystem.

Sharing and use of the FraudClassifier and ScamClassifier models throughout the industry is encouraged; any adoption of these models is voluntary at the discretion of each individual entity. The FraudClassifier and ScamClassifier models are not intended to result in mandates or regulations, and do not give any legal status, rights or responsibilities, nor are the models intended to define or imply liabilities for fraud loss or create legal definitions, regulatory or reporting requirements. Absent written consent, the FraudClassifier or ScamClassifier models may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.

Both “FraudClassifier” and “ScamClassifier” are service marks of the Federal Reserve Banks. A list of marks related to financial services products that are offered to financial institutions by the Federal Reserve Banks is available at FRBservices.org.