What’s new in payments these days? More specifically, what are the “next generation” technologies, use cases and worldwide trends that have the potential to further reshape our industry? This year’s Chicago Payments Symposium focused on Activating Next Gen Use Cases, including innovations in global payments, instant payments, digital currencies and open banking. In a world that continues to be upended by the COVID-19 pandemic, the event’s virtual setting facilitated discussions between a wide variety of financial institutions, service providers, end users, lawyers, economists, regulators and industry voices from around the country and world, to the benefit of its 450+ registrants on six continents.

Highlights from the two-day Chicago Payments Symposium:

- Opening Reception: Ellen Bromagen, first vice president and chief operating officer of the Federal Reserve Bank of Chicago, recapped developments around the globe over the last year, including progress made by the U.S. Faster Payments Council, Zelle® and the Clearing House on facilitating instant payments. The symposium also featured welcoming remarks from Federal Reserve Bank of Kansas City President and CEO Esther George, the Federal Reserve’s executive sponsor of the FedNowSM Service.

- Global trends and payments: Michael Froman offered a unique

perspective on both topics as a former U.S. trade representative, Council on Foreign Relations distinguished fellow and private sector banking executive. Froman focused on four global trends with implications for payments: the acceleration of digitalization; artificial intelligence and other new technologies that increase both risks and rewards in terms of “vast new opportunities to provide choice and service to consumers, efficiencies to businesses and increased effectiveness to governments;” new skepticism about previous assumptions that the world would become more integrated as part of a system based largely on Western principles of liberal, market-based democracy; and the rise of nationalism, nativism, populism, sectarianism and protectionism, which has led some governments to demand more control over local payment systems and/or payments data. Froman highlighted the importance of standards, rules and cross-sector collaboration to facilitate greater payments interoperability, immediate payments access and more seamless end-user experiences. Froman said this creates greater demand for collaboration among ecosystem participants so networks can offer more ubiquitous access across geographic markets.

perspective on both topics as a former U.S. trade representative, Council on Foreign Relations distinguished fellow and private sector banking executive. Froman focused on four global trends with implications for payments: the acceleration of digitalization; artificial intelligence and other new technologies that increase both risks and rewards in terms of “vast new opportunities to provide choice and service to consumers, efficiencies to businesses and increased effectiveness to governments;” new skepticism about previous assumptions that the world would become more integrated as part of a system based largely on Western principles of liberal, market-based democracy; and the rise of nationalism, nativism, populism, sectarianism and protectionism, which has led some governments to demand more control over local payment systems and/or payments data. Froman highlighted the importance of standards, rules and cross-sector collaboration to facilitate greater payments interoperability, immediate payments access and more seamless end-user experiences. Froman said this creates greater demand for collaboration among ecosystem participants so networks can offer more ubiquitous access across geographic markets. - Global payments developments: This wide-ranging panel discussion covered payments developments worldwide, including insights from current and former central bankers in India, Argentina and England and Citi’s head of industry initiatives. While it’s difficult to generalize because of country-to-country differences, the panelists agreed that payments innovation accelerates when “you get the economics right;” now is a good time to address cross-border inefficiencies that include slow speed, expense and lack of transparency; and the U.S. payments industry needs to “double down” on digitization and instant payments. Demand patterns vary by country and include high demand for business-to-business (B2B) payments in Brazil, while India’s payments volume has moved from predominantly B2B to a greater mix of person-to-person payments. India has led by proactively using three-year roadmaps. While discussing the global move toward function-based regulations, the panelists noted that it’s about the function your organization is performing, rather than its formal role, as the industry seeks to improve transparency and flexibility but reduce costs.

- Mark Gould fireside chat: Earlier this year, Mark Gould was named

chief payments executive of Federal Reserve Financial Services (FRFS (Off-site)) – and he offered his perspective based on both this new role and 30 years of working at the Federal Reserve. While Gould said he was proud to see the resiliency of payment systems worldwide during the ongoing pandemic, he also emphasized the payments industry’s need to be proactive about continued progress on everything from facilitating coin circulation to adoption of instant payments in the United States. “There will be more demand from consumers for instant payments and services, and financial institutions are going to have to meet those demands because, frankly, consumers have more and more options for faster payments.”

chief payments executive of Federal Reserve Financial Services (FRFS (Off-site)) – and he offered his perspective based on both this new role and 30 years of working at the Federal Reserve. While Gould said he was proud to see the resiliency of payment systems worldwide during the ongoing pandemic, he also emphasized the payments industry’s need to be proactive about continued progress on everything from facilitating coin circulation to adoption of instant payments in the United States. “There will be more demand from consumers for instant payments and services, and financial institutions are going to have to meet those demands because, frankly, consumers have more and more options for faster payments.” - Activating next gen faster payments use cases: This panel

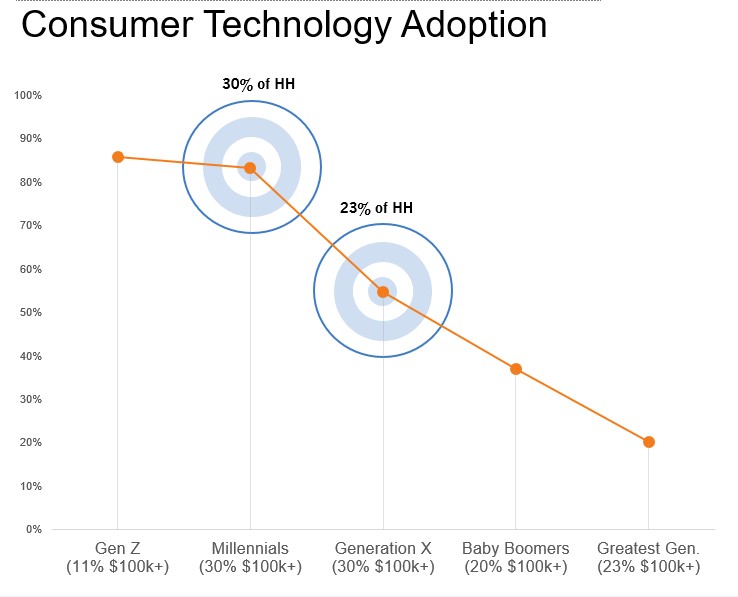

discussion focused on user needs, such as electronic invoicing with request-to-pay functionality to improve speed of accounts receivable, daily access to earnings for both gig workers and full-time employees, and instant insurance claims payments to improve both business efficiency and customer satisfaction. Industry readiness for instant payments remains a serious concern in the United States as it continues on its instant payments journey. Panelists from Airbnb, Inc., Bottomline Technologies, Trustly and FirstBank emphasized the speed and convenience demands they are hearing from end users, whose adoption patterns tend to vary by age as shown in the accompanying chart. The panelists said both network-level tools and similarities between the Clearing House’s real-time payments (RTP) and the FedNow Service will be helpful in achieving nationwide reach and ubiquity for instant payments in the United States. Federal Reserve panelist Dan Baum emphasized, “One thing we have known from the beginning is that we expect, and have planned for, the fact that use cases will evolve over time.”

discussion focused on user needs, such as electronic invoicing with request-to-pay functionality to improve speed of accounts receivable, daily access to earnings for both gig workers and full-time employees, and instant insurance claims payments to improve both business efficiency and customer satisfaction. Industry readiness for instant payments remains a serious concern in the United States as it continues on its instant payments journey. Panelists from Airbnb, Inc., Bottomline Technologies, Trustly and FirstBank emphasized the speed and convenience demands they are hearing from end users, whose adoption patterns tend to vary by age as shown in the accompanying chart. The panelists said both network-level tools and similarities between the Clearing House’s real-time payments (RTP) and the FedNow Service will be helpful in achieving nationwide reach and ubiquity for instant payments in the United States. Federal Reserve panelist Dan Baum emphasized, “One thing we have known from the beginning is that we expect, and have planned for, the fact that use cases will evolve over time.” - The future of finance is play: decentralization, money and the metaverse. Samantha Radocchia is a fintech entrepreneur and blockchain author who provided provocative insights about the pace of change based on these roles and her previous experiences as a “reformed gamer,” professional skydiver and blockchain entrepreneur. She likened opportunities for payments today to those of videogames that created virtual money and maps that advanced in sophistication from hard-to-fold paper documents to MapQuest to Google MapsTM. Her insight was that it required a complete change to transform from offering a paper map to delivering highly useful location-linked data. In addition, “The operating systems of the future are decentralized,” which creates an inflection point for innovations in blockchain and other types of payments.

- Digital currencies: It’s never been a more dynamic time for digital currencies, so this panel did not disappoint. The panelists represented varied perspectives from countries that have introduced a central bank digital currency or CBDC (the Bahamas’ sand dollar (Off-site) was the world’s first CBDC), are in the process of doing so (the e-krona (Off-site) in Sweden), are researching CBDCs (the United States (Off-site)) or are facilitating digital payments for internet businesses around the world (Circle (Off-site)). Moderator Avivah Litan of Gartner kicked off with a description of stablecoins, CBDC and the use cases driving this innovation, primarily cash replacement in Sweden and inclusion/remote payments in the Bahamas. The Federal Reserve’s Jim Cunha explained the Federal Reserve’s current research (Off-site) on a CBDC core engine, coding/testing and policy considerations about CBDC as a public good, while emphasizing that this research on benefits and tradeoffs is necessary in case the Fed is asked to create a digital form of the U.S. dollar. The panelists had a spirited discussion on the benefits and risks of decentralized payment platforms, prospects to encourage competition, better banking, monetizing money and opportunities for digital currencies to co-exist with other payment systems and advance financial inclusion.

- Raphael Bostic fireside chat: Raphael Bostic is president and CEO

of the Federal Reserve Bank of Atlanta and a hands-on thought leader on financial inclusion in payments. The pandemic highlighted the fact that many heavy users of cash, such as the unbanked and underbanked, don’t have access to smartphone-driven services such as digital wallets, mobile payments and P2P apps. The Federal Reserve Bank of Atlanta has formed a Special Committee on Payments Inclusion (Off-site) to focus on finding solutions for cash-reliant individuals to become better connected to the economy and innovative financial services. “We need to make the economy work for every American,” Bostic said, which has implications for making payments easier to make, building trust with underserved communities, and facilitating economic mobility for current and future generations. The power of taking very small steps to open up inclusion opportunities was presented as a key opportunity for every leader participating in the session.

of the Federal Reserve Bank of Atlanta and a hands-on thought leader on financial inclusion in payments. The pandemic highlighted the fact that many heavy users of cash, such as the unbanked and underbanked, don’t have access to smartphone-driven services such as digital wallets, mobile payments and P2P apps. The Federal Reserve Bank of Atlanta has formed a Special Committee on Payments Inclusion (Off-site) to focus on finding solutions for cash-reliant individuals to become better connected to the economy and innovative financial services. “We need to make the economy work for every American,” Bostic said, which has implications for making payments easier to make, building trust with underserved communities, and facilitating economic mobility for current and future generations. The power of taking very small steps to open up inclusion opportunities was presented as a key opportunity for every leader participating in the session. - Innovation and open banking: The panelists and moderator from Deloitte, North American Banking Co., Alacriti, BillGO, and Yodlee explored various aspects of open banking (Off-site), which allows third-party financial service providers open access to consumer banking, transaction and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs). Open banking is driven by regulation in some countries (e.g., countries in the European Union and Japan) and driven by fintech innovation in others (e.g., the United States). While some consumers welcome open banking because it offers them a more personalized experience based on their financial data, other consumers – and many financial institutions – have concerns about data sharing security. Panelists generally agreed that these concerns can be addressed successfully through increasingly function-driven and transparent regulation, standard setting and leveraging trusted API-based action rather than legacy-based screen scraping. The panelists expect improved industry understanding about costs and benefits about these and other innovations.

Visit the Chicago Payments Symposium 2021 agenda to learn more. Registered attendees can access the recorded sessions (Off-site) until approximately the end of November.