What is Check Fraud?

Check fraud is a financial crime that involves the unauthorized use of a paper or electronic check. Generally, check fraud falls into the following categories:

- Methods: ways in which fraudulent checks are created or obtained

- Types: primary types of fraudulent checks

- Schemes: how check fraud is facilitated

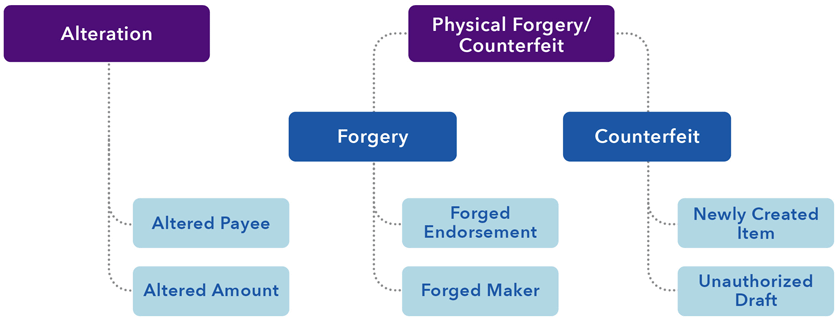

The inherent vulnerabilities of paper checks create significant risks, primarily fraud. Paper checks can be altered, counterfeited, forged and otherwise manipulated for the benefit of criminals. This module focuses primarily on the types of fraudulent checks. Understanding how different check fraud schemes are carried out is essential in determining how to identify and possibly, prevent losses.

Primary Types of Fraudulent Checks

For an overview of the different types of fraudulent checks, watch this video below.

Check fraud can be perpetrated in a variety of ways. While understanding the fraud type is important, it is equally important to know who is committing the fraud and the role they play in the scheme.

Watch this video for an overview of how check fraud may be committed by authorized parties or unauthorized parties.

Test Your Knowledge

Different types of fraudulent checks can be difficult to identify because criminals continue to become more sophisticated in their schemes. Review these common check fraud scenarios to see if you can identify the various types of fraudulent checks.

Downloadable Resources

Explore these resources for additional information on check fraud basics.

| Document Title | Format | Reading Time |

|---|---|---|

| Types of Fraudulent Checks (PDF) | Document | 5 minutes |

| Understanding Check Processing (PDF) | Document | 3 minutes |

| Who Commits Check Fraud? (PDF) | Document | 4 minutes |

| Infographic: Who Commits Check Fraud (PDF) | Document | 3 minutes |

| Why Check Fraud is Still Around (PDF) | Document | 7 minutes |

The check fraud mitigation toolkit was developed by the Federal Reserve to help educate the industry about check fraud and outline potential ways to help detect and mitigate this fraud type. Insights for this toolkit were provided through interviews with industry experts, publicly available research, and team member expertise. This toolkit is not intended to result in any regulatory or reporting requirements, imply any liabilities for fraud loss, or confer any legal status, legal definitions, or legal rights or responsibilities. While use of this toolkit throughout the industry is encouraged, utilization of the toolkit is voluntary at the discretion of each individual entity. Absent written consent, this toolkit may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.