Fight Scams with Better Reporting

The ScamClassifier model is a voluntary classification structure that supports consistent and detailed classification, reporting, analysis and identification of scams and related trends – a prerequisite to help promote accuracy of scam reporting, detection and mitigation. It can be used as a standalone classification structure – or applied either before or after the FraudClassifierSM model is used more broadly to classify an incident as fraud. Explore how the two models can be leveraged together.

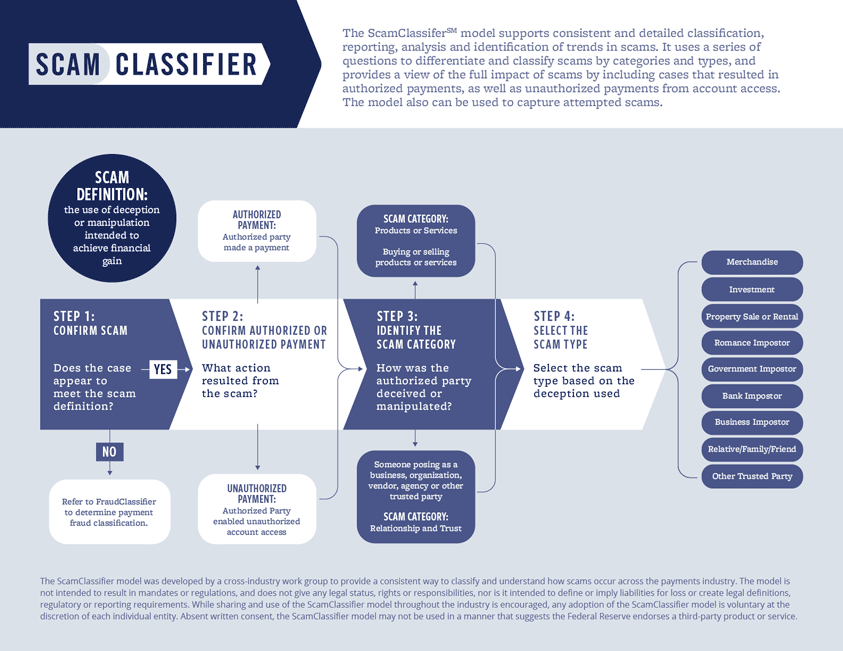

Similar to the FraudClassifier model, the ScamClassifier model does not depend on the communication method, payment application or payment type. The ScamClassifier model uses a series of questions to differentiate and classify scams by methods, categories and types. Classification begins with the scam definition, the use of deception or manipulation intended to achieve financial gain, to distinguish an actual or attempted scam from other types of fraud. Subsequent questions determine the results of the scam, method of deception and scam type. The model further facilitates accurate scam classification by including definitions and examples of the nine scam types shown in the graphic below.

How to Use the ScamClassifier Model

The model uses a series of questions to differentiate and classify scams and attempted scams by category and type.

- Step 1: Does the incident meet the definition of a scam: the use of deception or manipulation intended to achieve financial gain?

- Step 2: What action resulted from the scam?

- Either an authorized party was tricked into making the payment, OR the authorized party was tricked into enabling the fraudster to access the account.

- Step 3: How was the authorized party deceived or manipulated?

- Answers to this question are used to categorize the incident as either a products or services scam (e.g., to buy or sell something), OR as a relationship and trust scam (e.g., someone posing as a business, organization, vendor, agency or other trusted party). Incidents that are suspected of being fraudulent but not classified as scams can be further investigated using the FraudClassifier model.

- Step 4: Classify the scam type based on the type of deception.

- The nine scam types in the ScamClassifier model focus on characteristics of the impostor and desired outcome: merchandise scam, investment scam, property sale or rental scam, romance impostor scam, government impostor scam, bank impostor scam, business impostor scam, relative/family/friend scam or other trusted party scam.

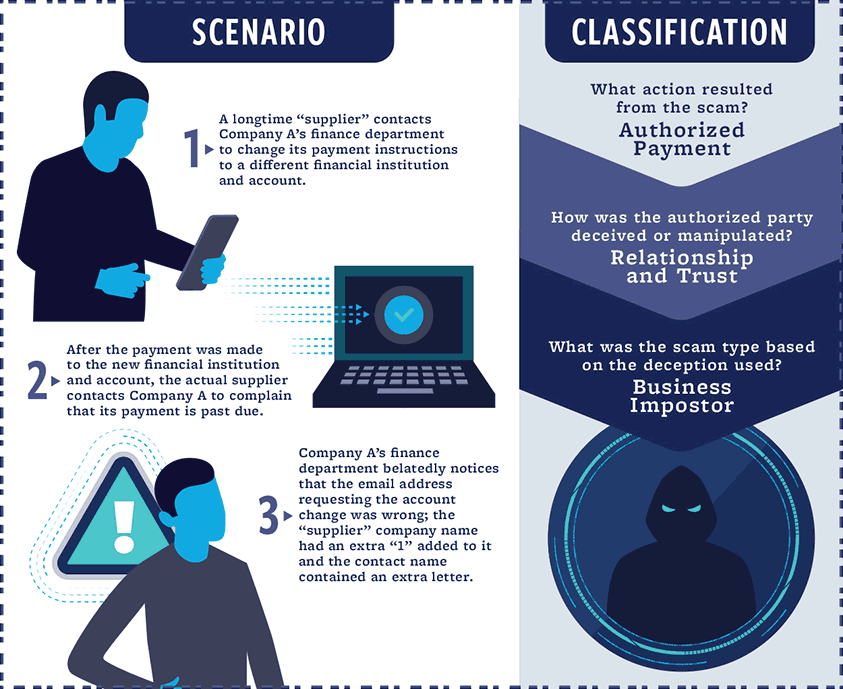

Below are example scam scenarios and how the ScamClassifier model can be applied.

Benefits and Next Steps

Expected benefits of adopting the ScamClassifier model include:

- Improved focus for scam detection, investigation and mitigation. Consistent application of the ScamClassifier model can help organizations better focus their detection and mitigation efforts to address specific scam types.

- Expedited scam claims intake. Organizations can use ScamClassifier model data to help them evaluate and improve their processes to route scam cases more quickly to the appropriate internal team for case management.

- Improved scam reporting. By using ScamClassifier model results as the basis for more detailed reporting of scam categories and scam types, organizations can standardize their reporting activities, improve trend detection, use this data to quantify the impact of scams on their organization and compare it to the industry.

Financial institutions and other organizations should evaluate their processes for fraud and scams to determine how the ScamClassifier model could provide consistency and value in combatting scams. In addition, organizations should assess potential integration of the ScamClassifier model into their existing scam classification case management tools.

Register below to access the full ScamClassifier model, including its supporting terms and definitions. In addition, signing up will allow you to be notified of model updates and opportunities to provide feedback about overall usability and potential enhancements.

The ScamClassifier model was developed by a scams definition and classification industry work group comprised of payments and fraud experts. A second effort, the scams information sharing industry work group, explored information sharing approaches to help mitigate scam activity. For more information on scams, visit the Fed’s Scams Mitigation Toolkit for insights and downloadable resources to help strengthen awareness, detection and mitigation of this type of fraud. Stay informed about these and other Federal Reserve efforts to support payment security and mitigate fraud by joining the FedPayments Improvement Community.

The ScamClassifier model is not intended to result in mandates or regulations, and does not give any legal status, rights or responsibilities, nor is it intended to define or imply liabilities for loss or create legal definitions, regulatory or reporting requirements. While sharing and use of the ScamClassifier model throughout the industry is encouraged, any adoption of the ScamClassifier model is voluntary at the discretion of each individual entity. Absent written consent, the ScamClassifier model may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.