“Better choices for U.S. consumers and businesses to send and receive convenient, cost-effective and timely cross-border payments.”

This statement above, published in the 2015 Strategies for Improving the U.S. Payment System paper, reflects the industry’s desire to address the significant challenges and pain points inherent in transacting globally.

As international commerce and personal payments continue to see significant growth, a focus on improving these experiences is more important than ever. In the past five years, the cross-border space has seen noteworthy market activity encompassing commercial endeavors, public sector initiatives and private sector collaboration. While considerable progress has been made over the years, opportunities for additional improvements remain.

The Cross-Border Payments Journey

The Federal Reserve conducted an assessment of the current cross-border payments landscape in late 2019 to better understand developments and ongoing challenges. This assessment, which involved secondary research and consultation with subject matter experts, was undertaken to encourage stakeholder dialogue and engagement in improvement opportunities.

Key findings from this assessment that are fundamental to understanding this complex payments ecosystem include:

- Cross-border payments are inherently more complex than domestic payments and are often slower, less transparent and more expensive due to the lack of an end-to-end system or rule set, and the need to transact in different currencies and time zones, and comply with different regulatory requirements.

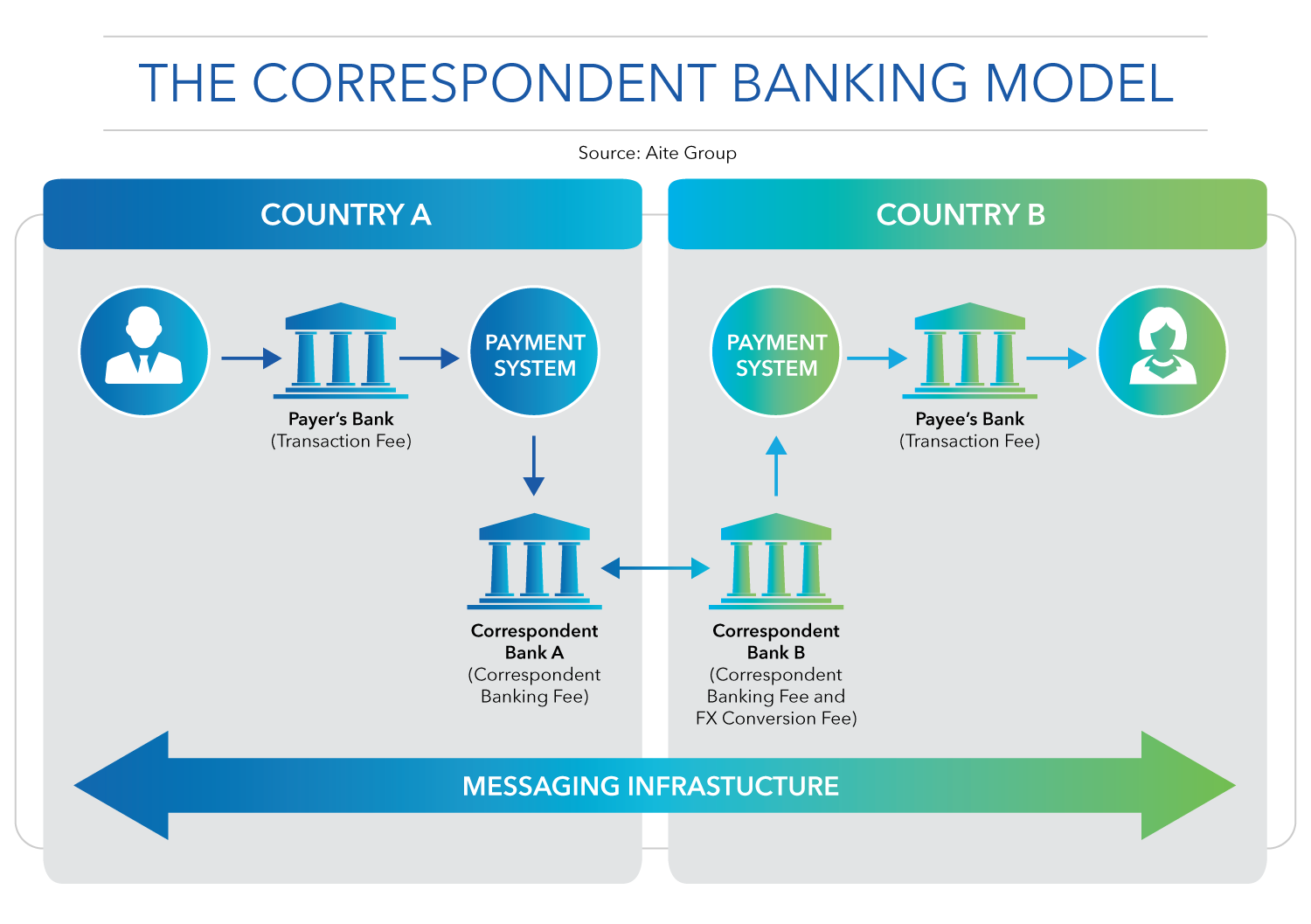

- Correspondent banking remains the most prevalent cross-border payment arrangement. Transactions can involve multiple hops through intermediaries, which can increase fees and delay availability of funds. This arrangement relies upon banks holding deposits owned by other respondent banks in order to provide payments and services on behalf of respondent banks.

- Cross-border payments have grown across all use cases due to globalization, growth in global e-commerce, migration and record levels of worker remittance payments. Estimates suggest cross-border transactions totaled around $29 trillion in 2019.i

- Use cases are distinct but pain points are largely the same among businesses and consumers. Since cross-border payments rarely go directly from sender to receiver, most pain points relate to speed, transparency and cost.

- Systemic challenges are difficult to overcome.

- Regulatory: Different jurisdictions have different regulatory requirements, which introduces risk and adds cost for providers.

- Correspondent banking: The number of correspondent banking relationships is steadily declining, particularly where volumes do not justify compliance costs, and in jurisdictions where transactions may be high risk, or where compliance is difficult.

- Liquidity: Businesses and financial institutions could face liquidity challenges with trillions of dollars sitting in nostro/vostro transactional accounts around the world, tying up capital that could be used in other ways.

- Many improvement initiatives are underway targeting certain challenges with varying or uncertain impact. While much of the innovation is happening within the private sector, both private and public sector initiatives exist to address pain points and challenges. There is also a growing trend toward partnerships between established firms and new entrant providers to achieve both scale and innovation throughout the cross-border payments ecosystem.

- These initiatives continue to gain traction and generally address the same pain points and challenges summarized here, including:

- Decline in correspondent banking

- Settlement

- Access and convenience

- Cost and transparency

The Fed’s objective is to continue engaging with stakeholders across the payments ecosystem to learn more about provider and user experiences, market developments, and the impact that private sector and global initiatives are having on cross-border payments.

I Glenbrook Payments, 2019 estimates provided to Federal Reserve