By Jim Cunha, Senior Vice President, Federal Reserve Bank of Boston

By Jim Cunha, Senior Vice President, Federal Reserve Bank of Boston

Over the past year, we’ve spoken with more than 50 industry experts about the growing issue of synthetic identity payments fraud and its impact on the financial services industry. Today, we published our most recent white paper in a series on this topic, Mitigating Synthetic Identity Fraud in the U.S. Payment System (PDF).

Key highlights include:

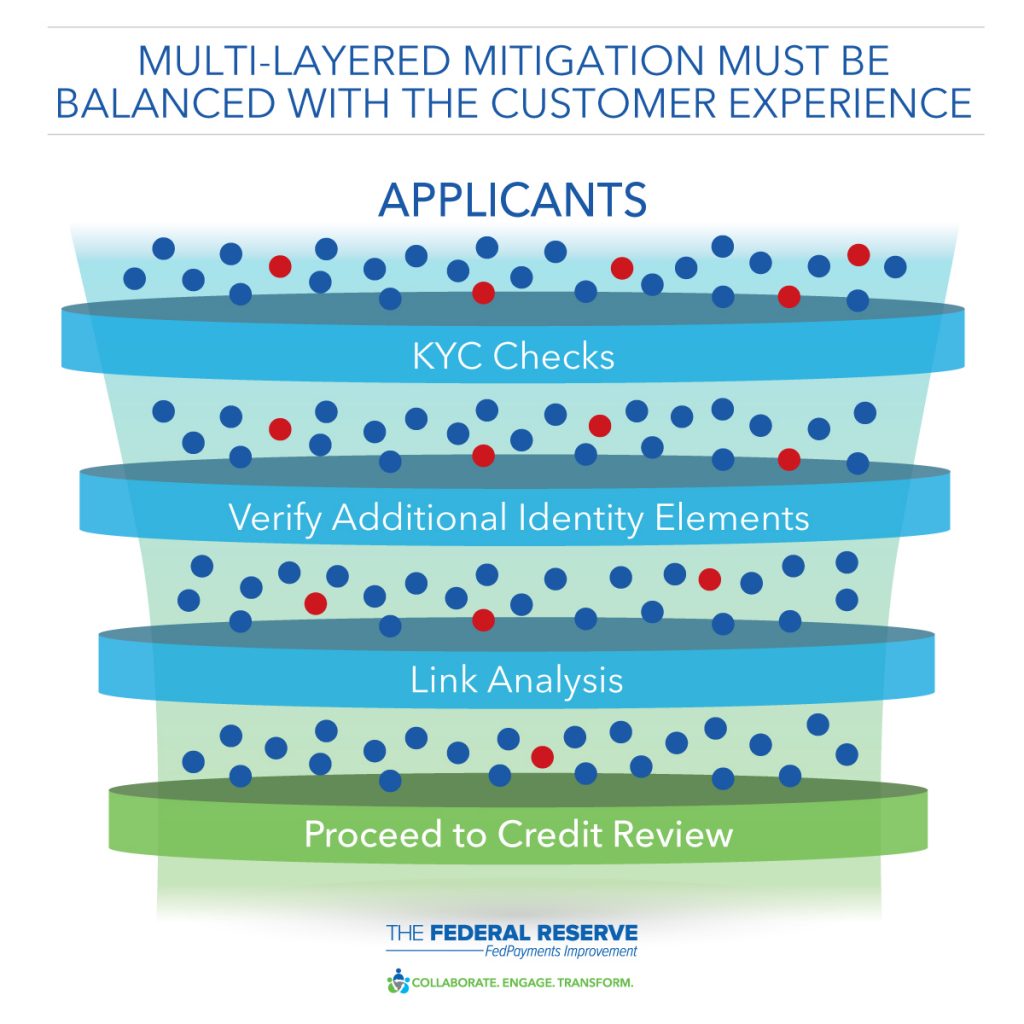

- Organizations that leverage a multi-layered approach that employs both manual and technological data analysis have the best chance to identify and mitigate fraud caused by synthetics, according to industry experts.

- As payments stakeholders share more information about trends, behaviors, threats and best practices, they can improve the industry’s collective synthetic identity fraud detection and mitigation practices.

- The regulatory environment is evolving to provide additional protections for consumers and mechanisms for financial institutions to fight fraud. Industry experts urge organizations to remain aware that fraudsters may still find opportunities to exploit these for their own benefit.

I encourage you to read our most recent white paper (PDF) and watch for opportunities to further engage with us in the coming months. We look forward to continuing our conversation with the industry about payments security.