Numerous initiatives to enhance the global cross-border payments ecosystem are underway, and the Federal Reserve has closely followed the G20 Roadmap for Enhancing Cross-Border Payments published by the Financial Stability Board (FSB) in collaboration with the Committee on Payments and Market Infrastructures (CPMI).

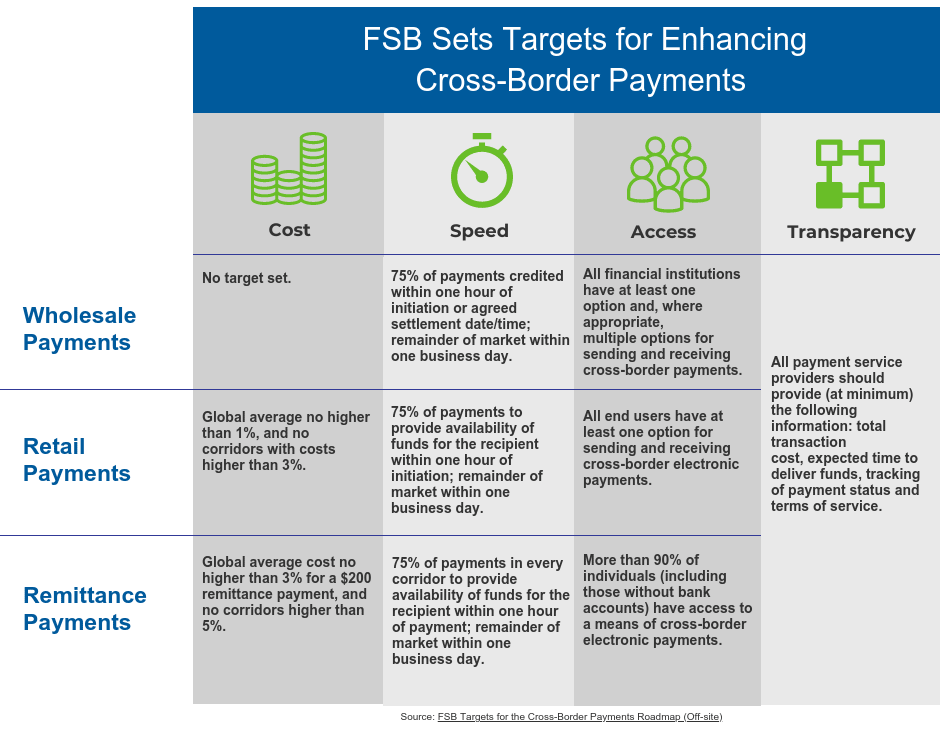

In its most recent report, the FSB released quantitative targets for its improvement roadmap (Off-site). These targets intend to establish collective goals for the public and private sector for improving the cost, speed, accessibility and transparency of cross-border payments.

Targets were provided across wholesale, retail and remittance market segments. Here, wholesale payments are defined as transactions between financial institutions, including both banks and non-banks. Retail payments include cross-border traditional commerce and e-commerce, tourism, bill payments to a provider abroad, cross-border electronic transfers and non-remittance person-to-person (P2P) payments. Last, remittance payments are defined as P2P payments primarily to receivers in emerging markets and developing economies.

Read through each quantitative target below for wholesale, retail and remittance payments organized by the four key challenges.

Target: Cost

Costs related to cross border payments include all elements surrounding the price paid by end-users. According to the FSB, numerous market segments, service levels and regions make cost difficult to estimate and disclose in advance of a transaction.

Cost of wholesale payments, for example, varies greatly and is heavily dependent upon participant’s transaction volumes and value. Because of the difficulty defining and measuring an average amount, a target was not set for this segment.

The FSB set the cost target for retail payments to a maximum of 1 percent of the value of the transaction globally, with no individual corridors exceeding 3 percent, by the end of 2027. Today, costs for card issuers can reach 10 percent depending on fees and foreign exchange (FX) price margin.

The cost target set for remittance payments follows a previously determined United Nations Sustainable Development Goal, which seeks to achieve a 3 percent maximum global average cost per $200 remittance payment by 2030, with no individual corridor exceeding 5 percent. Currently, the global average is 6.38 percent per $200 remittance payment.

Target: Speed

As stated by the FSB, speed varies based on several factors, including time zone differences, number of intermediaries in the payment chain, pay-out method and real-time gross settlement operating hours. And as faster and instant payment systems gain traction domestically, there may also be long-term implications for the speed of cross-border payments.

For wholesale payments, the FSB sets a target of under one hour of payment initiation to achieve crediting and reconciliation for 75 percent of payments. Wholesale payments today typically take 48 hours or longer in traditional correspondent banking, and FX transactions may take up to several days for settlement. Similarly, in both retail and remittance payments, a target was set for availability of funds for the recipient within one hour of initiation for 75 percent of payments.

Target: Access

Targets for access to cross-border payments consider end-user perspectives. A decline in correspondent banking relationships results in some jurisdictions facing inadequate access to the global financial system across each market segment.

In wholesale and retailpayments, the FSB states financial institutions and end-users should have at least one reliable option in terms of infrastructures and providers and multiple options to send and receive payments.

For remittance payments, the FSB aims for more than 90 percent of individuals wanting to send or receive a remittance payment, including those without bank accounts, to have access to cross-border electronic remittance payments.

Target: Transparency

The FSB defines transparency in cross-border payments as necessary information about the transaction and the transaction’s progress as it is underway.

For all three market segments – wholesale, retail, and remittance – the FSB indicates payment service providers should provide total transaction cost with all relevant charges to payers and payees. Depending on the transaction, this includes sending and receiving fees, FX rate and currency conversion charges, expected time to deliver funds, tracking of payment status and terms of service.

Measurement of Progress Toward Targets

As the cross-border roadmap for improvements work continues, the FSB will monitor and publicly report on the stated targets over time, with the intention of meeting most targets by the end of 2027. By October 2022, the FSB plans to provide a report to the G20 and the public with further details of the implementation approach for progress monitoring.

As a member of the CPMI Cross-border Payments Task Force, the Federal Reserve will continue participating in this global collaboration to enhance cross-border payments. The Federal Reserve also independently monitors developments in cross-border payments and engages with stakeholders to gather input and foster broader industry education and dialogue. Check back for updates and to learn more about cross-border payments initiatives underway.