For years, the business-to-business (B2B) payments industry has been challenged by the manual processes required when exchanging necessary remittance information to post a payment to accounting systems. In September 2021, the Federal Reserve and the Business Payments Coalition (BPC) convened a new industry effort to solve for this challenge and catalyze the modernization of B2B payments.

The Remittance Delivery Assessment Work Group

Comprised of more than 40 industry organizations, the Remittance Delivery Assessment Work Group dedicated eight months to assessing whether the electronic invoice (e-invoice) exchange framework can also facilitate delivery of electronic remittance (e-remittance) information for all payment types. This work leveraged the progress and momentum of the BPC’s E-invoice Exchange Market Pilot that solves very similar delivery challenges for e-invoices.

The work group evaluated the key architectural components of an exchange framework relative to the needs for delivering remittance information. The components included the method of discovering the electronic address to send remittance information, network delivery communication standards, the data exchange standard, and the concept of leveraging service providers to facilitate the remittance exchange with minimal changes to business accounting systems.

Assessment Report Findings

Following the assessment, the work group determined it is feasible to establish a remittance exchange framework (Off-site, PDF), similar to the e-invoice exchange framework, with some minor adaptations. The exchange framework provides a standard, secure way to deliver remittance information that will minimize the need for businesses to make changes to their account payable (AP) and account receivable (AR) systems, which is key to easing adoption. Once implemented, businesses will be able to significantly expand electronic delivery to support automated processing.

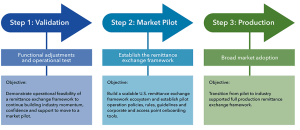

To realize the vision of a modern remittance delivery system, the work group recommends that industry stakeholders proceed forward with the following three steps:

- Validation: Demonstrate operational feasibility of a remittance exchange framework to continue building industry momentum, confidence and support.

- Market Pilot: Build a scalable U.S. remittance exchange framework and establish pilot operation policies, rules, guidelines, and corporate access point onboarding tools.

- Production: Transition from pilot to industry supported full production remittance exchange framework.

Why It Matters

The work group’s assessment concluded (Off-site, PDF) an exchange framework is a viable solution to deliver payment-agnostic remittance information in support of straight-through processing, or a completely automated payments process from start to finish. Further, the assessment supports the idea that the industry should continue progressing and building on innovative approaches toward e-remittance exchange.

With the feasibility assessment complete, the remittance work will now progress to the validation phase. In fact, the work group encourages the industry to begin the validation step as soon as possible to maintain the momentum of this work and prepare for the subsequent market pilot and production steps. These recommended next steps are parallel to the successful path paved by the BPC’s e-invoice exchange framework.

When implemented, an e-remittance exchange framework has the potential to mitigate the challenges that have existed for years with manual remittance information exchange in the B2B payments industry and realize the benefits of straight-through processing. The contributions of the Remittance Delivery Assessment Work Group have been integral to advancing solution-oriented approaches to help solve for e-remittance delivery.

The BPC and the Fed will continue to provide updates on this innovative work, including progress, toward more streamlined, modern B2B payments processes. To stay informed of further progress join the FedPayments Improvement Community (select “E-invoicing” and “Electronic Payments and Remittance” under the interest preferences). Follow FedPayments Improvement on LinkedIn (Off-site) and Twitter (Off-site).