Broad View of the Consumer Payments Landscape

The consumer experience encompasses users’ perceptions of how easy it is to make or receive a payment for everyday purchases, bills, money transfers and exchanges. Every payment is facilitated by front- and back-end technologies. User experience quality can heavily influence providers’ decisions about how and when they enhance these payment technologies.

Payment options have grown significantly along with individuals’ usage of mobile phones, wallets, apps and P2P networks. This trend is fueled by the growth of nonbank payment providers, such as Venmo®, PayPal® and Cash App®. Bank providers such as Early Warning Services, a consortium of seven large banks, also have entered the P2P space, launching Zelle® in 2017.

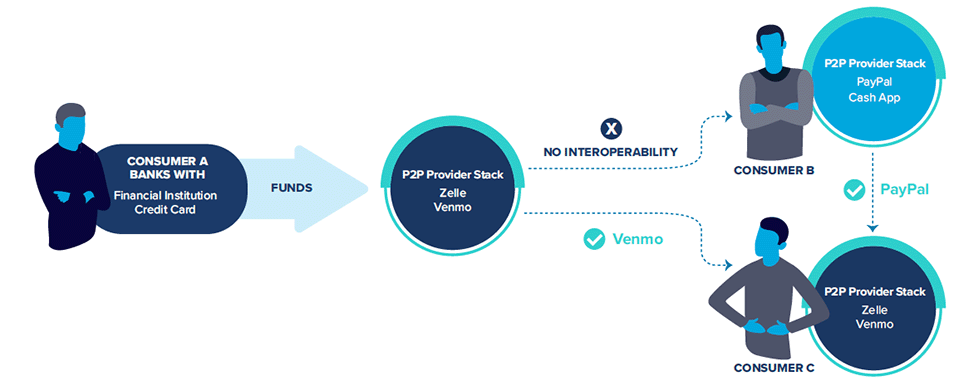

When considering P2P networks and digital wallets, it’s important to note P2P networks are closed-loop payment networks, meaning that a payment must happen within a certain network. Examples include PayPal, Venmo and Cash App. Digital wallets are software applications that store payment or account details to facilitate traditional payments, serving as a digital conduit for a payment method. Examples include Google WalletTM, Apple Pay® and the Starbucks digital wallet.

Benefits and Challenges

While the increased number of payment options benefits the consumer experience through greater choice, speed and other features, it also has fragmented the payments landscape. This can impact the consumer experience due to user confusion about settlement and other behind-the-scenes payment processing mechanics, complexity as people subscribe to and store funds in multiple accounts, security concerns and a lack of interoperability between networks.

As consumers gravitate to nonbank providers for payments, merchants are capitalizing on digitalization and seeking ways to reduce their payment costs. Payment acceptance by merchants and other organizations is heavily influenced by consumer demand, which in turn is based partly on the consumer experience. For example, diners in restaurants have been receptive to conveniently ordering and paying for meals via the Toast payment tool.

Digital payments work well for consumers who have access to the traditional banking system – but leave out many unbanked consumers who do not have access to digital channels. In addition, consumers may be unaware of the lack of Federal Deposit Insurance Corp. (FDIC) protections (Off-site) for closed-loop networks and the mechanics of underlying payment processing (such as settlement speed). The latter could cause consumers to incur costs due to different settlement times between payment networks.

Trends by the Numbers

Which key trends are influencing the consumer payments experience in various front-end and underlying payment rails – and are expected to continue shaping the future user experience? Is increased usage of digital wallets driving up payment costs for the banks and credit unions that accept them, and/or impacting consumers’ deposits into their financial institution accounts?

Reported payment volumes for digital wallets and P2P networks indicate increasing usage of digital platforms, including:

- Zelle reported (Off-site) that consumers and small businesses sent 2.9 billion transactions in 2023, amounting to $806 billion, both up 28% year-over-year.

- PayPal’s total payment volume grew 15% to $409.8 billion and payment transactions increased 13% to $6.8 billion in the fourth quarter of 2023.

- Venmo’s estimated 2023 annual payments volume (Off-site) totaled $298 billion.

- Apple Pay reported volume of $6 trillion (Off-site) during 2022. However, Apple Pay and Google Wallet are not processing the payments (Off-site). Rather, they direct payments to Visa®, Mastercard® or other established payment rails.

According to the 2023 Survey and Diary of Consumer Payment Choice (Off-Site) and the 2022 triennial Federal Reserve Payments Study (Off-site):

- Consumers use cash and checks less. Cash in general has declined over the last few years. However, cash use appears to be growing. One in four consumers paid with cash for in-person transactions in 2023. Check and ATM withdrawals have declined in number while increasing in value, though 71% of consumers stated they used checks in 2023.

- The value of noncash payments increased each year between 2018 and 2021 at an average of 9.5% per year and totaled $128.51 trillion in 2021. Legacy methods, such as ACH and checks, remain the most prominent payment methods by dollar value – and frequently, power newer, front-end payment methods. In 2023, ACH payments made up 42% of consumer payments by value.

- Debit and credit card use continued to rise, making up 30% and 32%, respectively, of consumer payments in 2023. These rails are connected to newer payment methods, such as mobile wallets and P2P networks. The value of credit card payments substantially rose in recent years, as did the value of prepaid card payments, which have been the preferred method for electronic benefit transfers.

Why the Consumer Experience is Important

The user experience is at the center of payments, making this one of the biggest drivers of shifts and improvements in the payment ecosystem. User experience can shape where payments go in the future, so providers in the market are constantly trying to predict and accurately respond to consumer preferences and needs. While different user groups have different requirements and preferences, all desire and deserve safe, fast, efficient and accessible payments.

The Federal Reserve monitors and analyzes the payments landscape to understand the dynamic between users and providers, how different types of users interact with the payment system, how new technologies are being implemented, how they impact users, who benefits from the system’s structure versus who bears the costs, standards and consumer protection best practices.

Stay informed about future educational articles on the evolving U.S. payments landscape by joining the FedPayments Improvement Community.