Faster payments have become a way of life for many consumers who regularly use mobile devices to track their finances as well as payment apps to send and receive payments among friends and family. Now, according to a new survey from the Federal Reserve (PDF), consumers are seeking faster payments in even more areas of their increasingly on-demand lives.

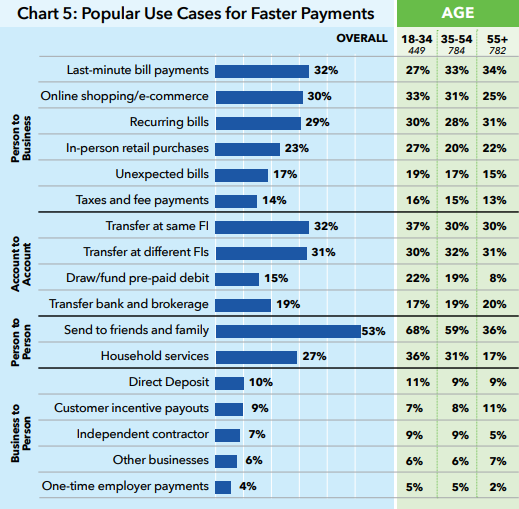

The survey of over 2,000 consumers found that more than six in 10 say they plan to use faster payments more in the future. And while person-to-person (P2P) transactions continue to be a prominent use case for faster payments, four out of five consumers say they are interested in faster options to pay businesses.

“From recurring payments to last-minute bill pay, consumers are looking for faster payment options that give them more control over the timing of their transactions with businesses. These findings suggest that providing consumers with safe, efficient instant payment methods for business transactions needs to be a key industry priority.”

Connie Theien

Senior vice president and head of industry relations for the Federal Reserve System

With instant payments, which are a type of faster payments, a payee’s account is credited within seconds of payment initiation, enabling them to have immediate access to funds and allowing payers to know exactly when their money has reached its destination. This can ease the concern of late fees and gives consumers the ability to pay bills exactly when they are due.

The demand for faster payments spans age groups and has intensified in the wake of the COVID-19 pandemic, according to the survey. These findings align with a survey of businesses published by the Federal Reserve Banks in the fall of 2021, which showed that nine out of 10 businesses expect to be able to make and receive faster payments in the next three years.

In response to industry demand for faster payments, the Federal Reserve is developing the FedNowSM Service (Off-site), a new infrastructure for instant payments that will operate around the clock, 365 days a year.

“The Federal Reserve’s FedNow Service will allow financial institutions of all sizes to offer safe and instant payment services for their customers when it launches in 2023,” said Nick Stanescu, FedNow Service business executive. “In addition to the growing demand for faster payments to businesses, the survey shows P2P continues to be one of the strongest use cases for instant payments, which validates our direction for the FedNow Service.”

Other key findings from the consumer survey included:

- Nearly seven out of 10 use mobile payment devices to send or receive payments.

- About 70% say access to enhanced faster payment capabilities from their current financial institution(s) is an important satisfaction driver.

- Nearly 80% are interested in leveraging faster payments to pay businesses.

- More than 60% want a real-time view of their account balance and immediate posting of payments they initiate.

- 83% are using a fintech payment app or digital wallet at least occasionally to complete transactions, including 71% of those 55 and older.

A full report on the survey can be found here (PDF).

Learn more about the FedNow Service

For more information on FedNow Service features and functionality, visit FedNowExplorer.org (Off-site). You can also stay up to date on our instant payments initiatives by signing up for FedNow News (Off-site).