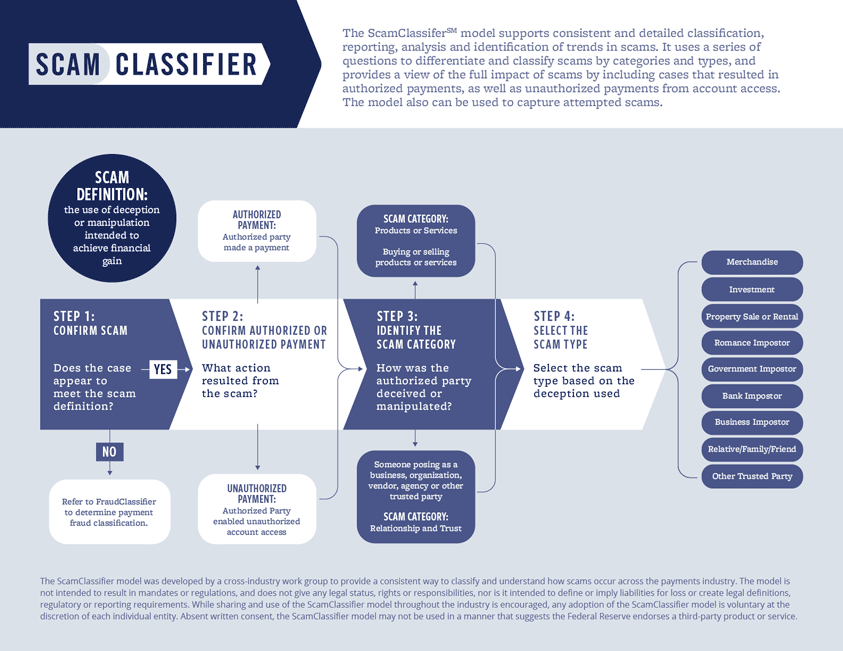

The payments industry now has a new tool to improve scam reporting, detection and mitigation. Released in summer 2024, the ScamClassifierSM model supports consistent and detailed classification, reporting, analysis and identification of scams, attempted scams and related trends.

The Federal Reserve and a work group of payments and fraud experts developed the ScamClassifier model because scams are growing in both prevalence and severity. For example, more than $10 billion (Off-site) in 2023 consumer fraud losses were reported to the Federal Trade Commission, a 14% increase from 2022. Investment scam losses were the largest category, up 21% from the previous year to more than $4.6 billion. As another example, scammers pose as legitimate entities to solicit payments through techniques that include business email compromise (BEC, Off-site), which is classified as part of the business impostor scam type. BEC complaints to the FBI’s Internet Crime Complaint Center (Off-site) rose 7% in 2023, to 21,489 complaints totaling $2.9 billion in reported losses.

“Scams are a hot topic across the payments industry and within many organizations. We are seeing a groundswell of support for fighting this type of fraud – and the ScamClassifier model can help us do so through better classification and reporting.”

Mike Timoney, vice president of payments improvement

Federal Reserve Financial Services

Similar to the FraudClassifierSM model announced by the Federal Reserve in 2020, the ScamClassifier model uses a series of questions to differentiate and classify scams and attempted scams by category and type.

Expected benefits of adopting the ScamClassifier model include:

- Improved focus for scam detection, investigation and mitigation. Consistent application of the ScamClassifier model can help organizations better focus their detection and mitigation efforts to address specific scam types.

- Expedited scam claims intake. Organizations can use ScamClassifier model data to help them evaluate and improve their processes to route scam cases more quickly to the appropriate internal team for case management.

- Improved scam reporting. By using ScamClassifier model results as the basis for more detailed reporting of scam categories and scam types, organizations can standardize their reporting activities, improve trend detection, use this data to quantify the impact of scams on their organization and compare it to the industry.

Financial institutions and other organizations should evaluate their processes for fraud and scams to determine how the ScamClassifier model could provide consistency and value in combatting scams. In addition, organizations should assess potential integration of the ScamClassifier model into their existing scam classification case management tools.

Learn more about the ScamClassifier model, including its supporting terms and definitions and examples of classification scenarios.

Join the FedPayments Improvement Community for updates on the ScamClassifier model and how information sharing about scams can help the industry, as well as the Fed’s continued efforts to help modernize the U.S. payment system.

The ScamClassifier model is not intended to result in mandates or regulations, and does not give any legal status, rights or responsibilities, nor is it intended to define or imply liabilities for loss or create legal definitions, regulatory or reporting requirements. While sharing and use of the ScamClassifier model throughout the industry is encouraged, any adoption of the ScamClassifier model is voluntary at the discretion of each individual entity. Absent written consent, the ScamClassifier model may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.