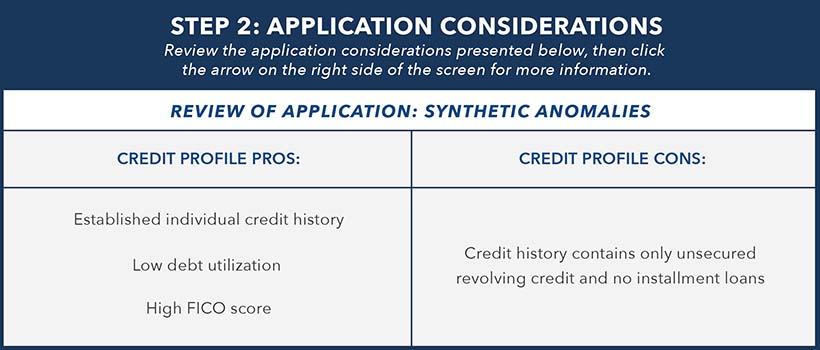

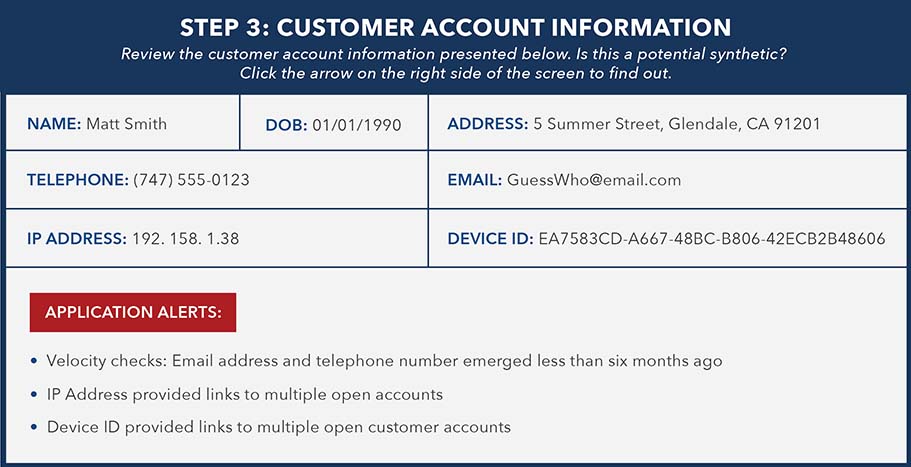

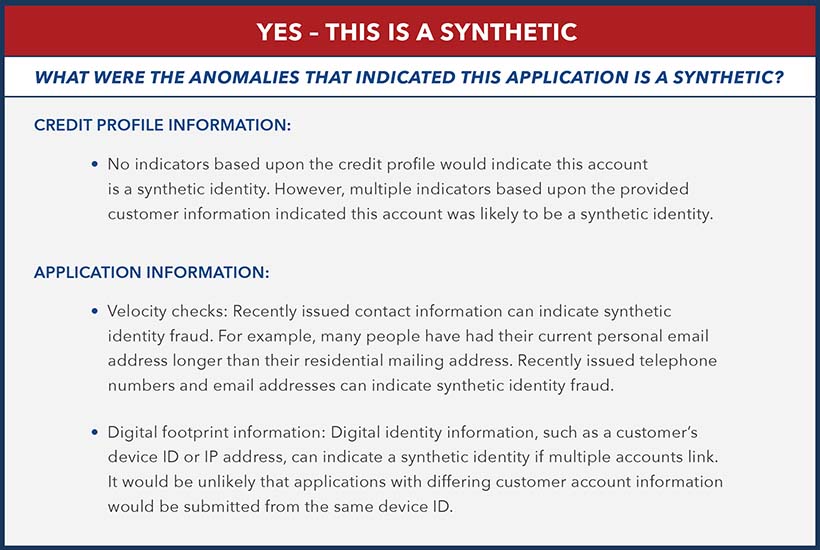

Test Your Knowledge: Can You Spot the Synthetic Identities?

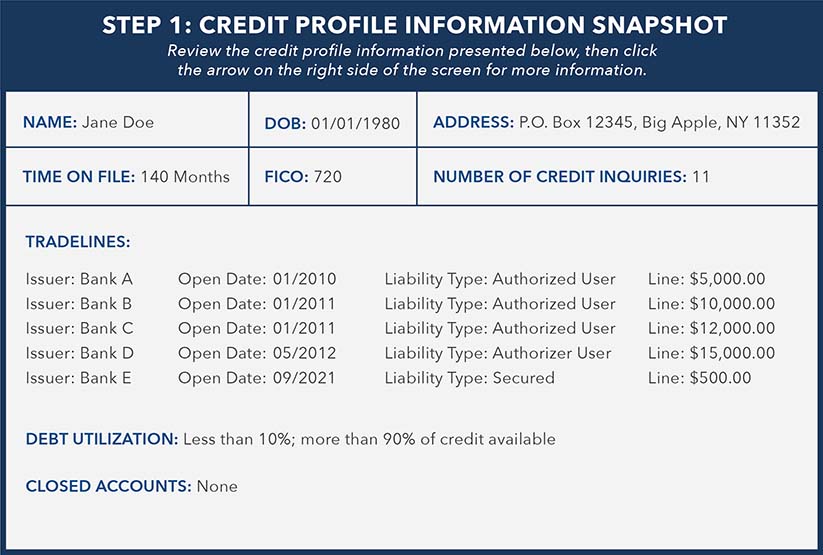

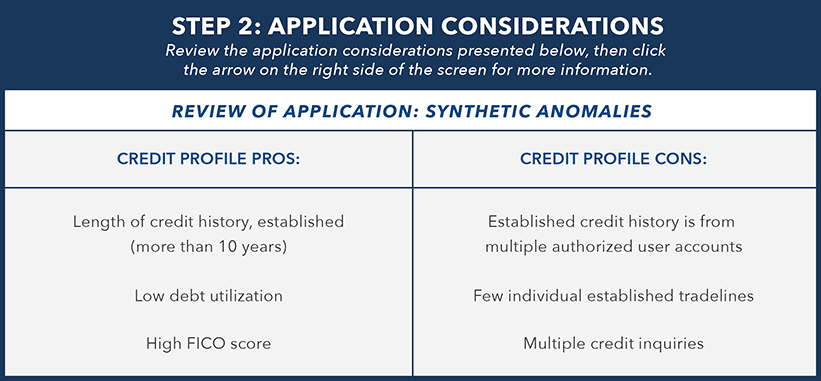

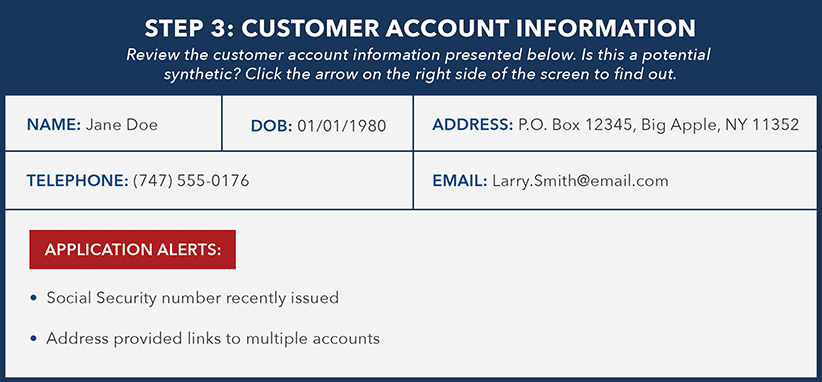

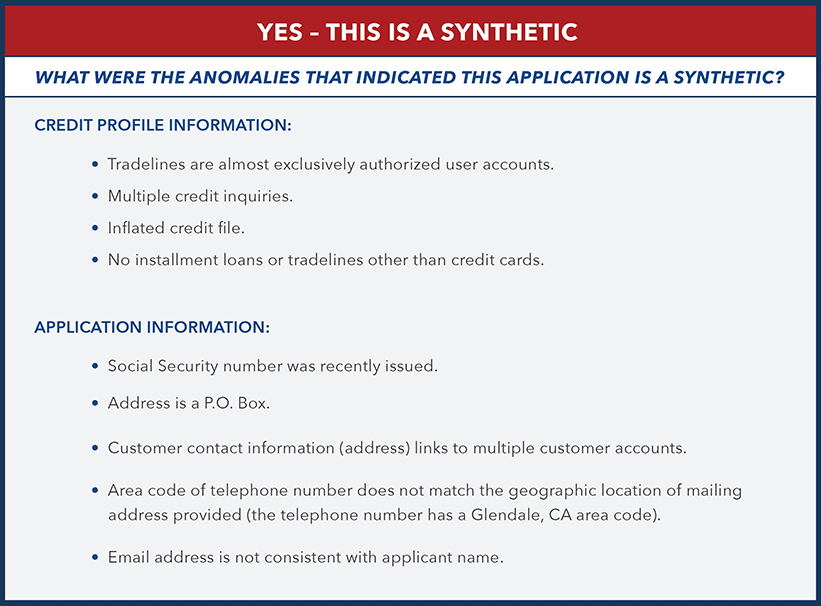

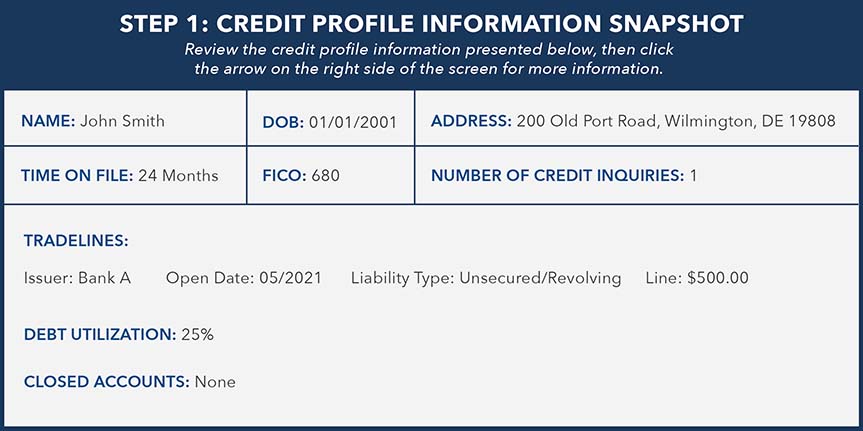

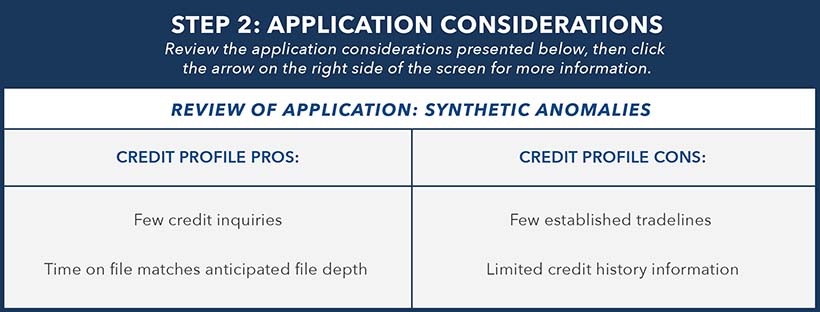

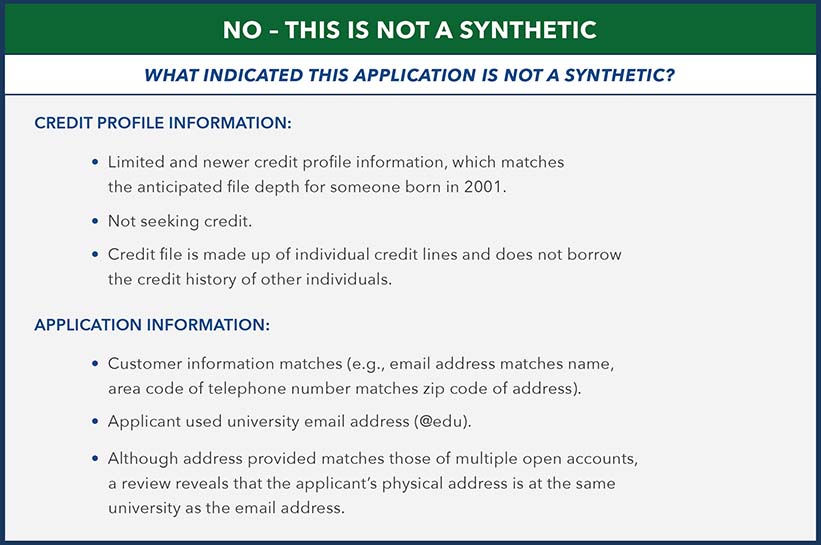

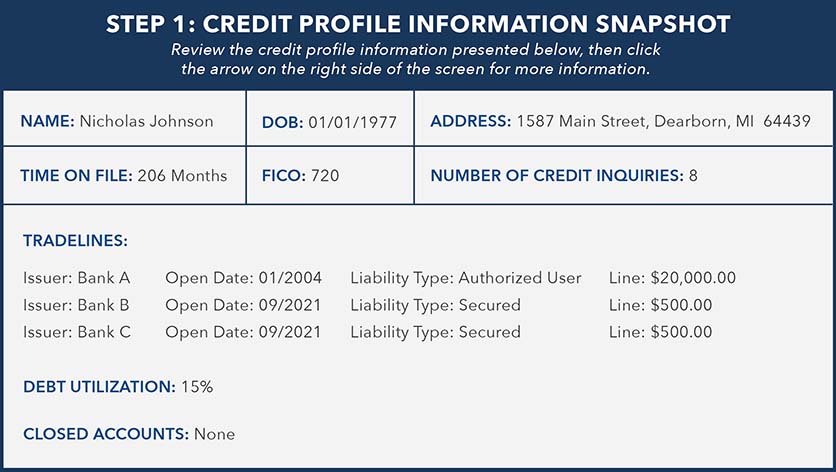

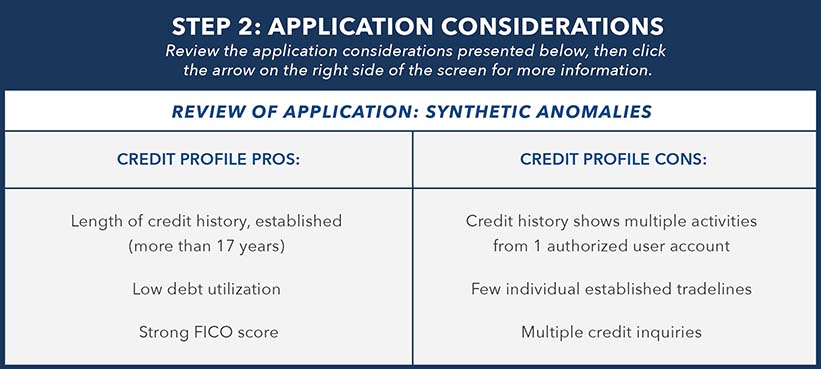

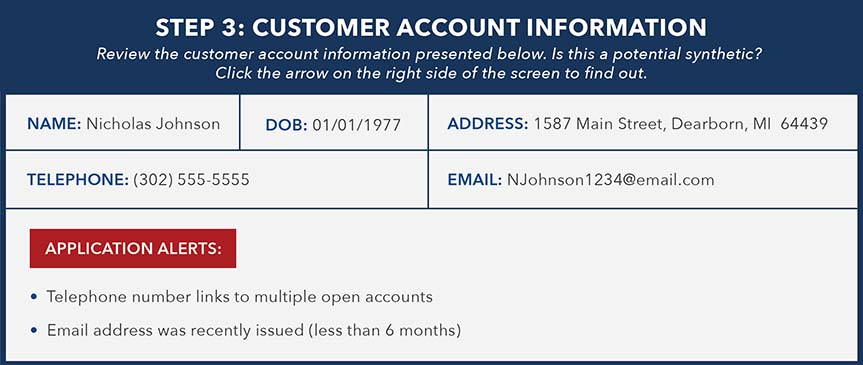

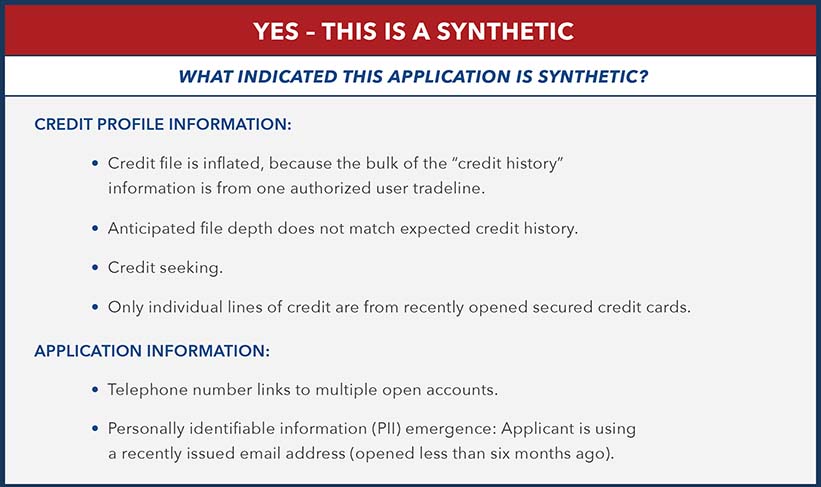

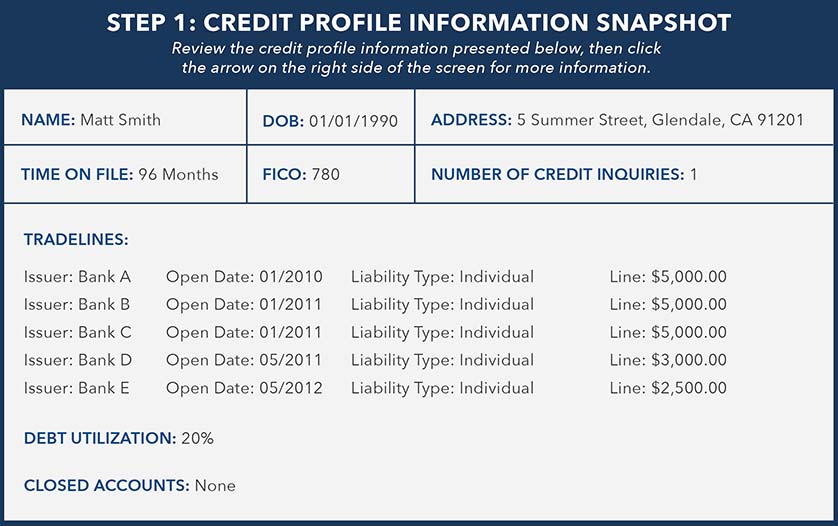

Synthetic identity fraud can be difficult to detect because the synthetics created by fraudsters appear to be real customers, and often, these identities pass Know Your Customer (KYC) verification. Below are four examples of account applications – can you spot the synthetics?

Click the arrows on the side of (or buttons below) each graphic to navigate through the scenarios.

Scenario 1

Scenario 2

Scenario 3

Scenario 4

The synthetic identity fraud mitigation toolkit was developed by the Federal Reserve to help educate the industry about synthetic identity fraud and outline potential ways to help detect and mitigate this fraud type. Insights for this toolkit were provided through interviews with industry experts, publicly available research, and team member expertise. This toolkit is not intended to result in any regulatory or reporting requirements, imply any liabilities for fraud loss, or confer any legal status, legal definitions, or legal rights or responsibilities. While use of this toolkit throughout the industry is encouraged, utilization of the toolkit is voluntary at the discretion of each individual entity. Absent written consent, this toolkit may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.